Cohesive Consistent Confident

4mZ0Bv

4mZ0Bv

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Henry Boot PLC<br />

Annual Report and Financial Statements for the year ended 31 December 2015<br />

www.henryboot.co.uk<br />

Stock Code: BHY<br />

Financial Statements<br />

Notes to the Financial Statements continued<br />

for the year ended 31 December 2015<br />

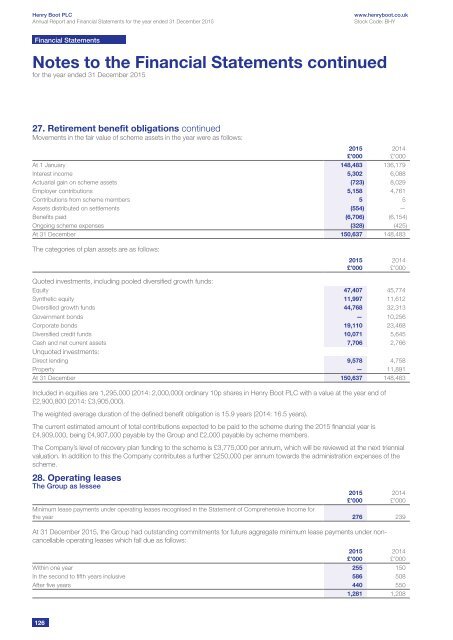

27. Retirement benefit obligations continued<br />

Movements in the fair value of scheme assets in the year were as follows:<br />

At 1 January 148,483 136,179<br />

Interest income 5,302 6,088<br />

Actuarial gain on scheme assets (723) 8,029<br />

Employer contributions 5,158 4,761<br />

Contributions from scheme members 5 5<br />

Assets distributed on settlements (554) —<br />

Benefits paid (6,706) (6,154)<br />

Ongoing scheme expenses (328) (425)<br />

At 31 December 150,637 148,483<br />

The categories of plan assets are as follows:<br />

2015<br />

£’000<br />

2014<br />

£’000<br />

2015<br />

£’000<br />

2014<br />

£’000<br />

Quoted investments, including pooled diversified growth funds:<br />

Equity 47,407 45,774<br />

Synthetic equity 11,997 11,612<br />

Diversified growth funds 44,768 32,313<br />

Government bonds — 10,256<br />

Corporate bonds 19,110 23,468<br />

Diversified credit funds 10,071 5,645<br />

Cash and net current assets 7,706 2,766<br />

Unquoted investments:<br />

Direct lending 9,578 4,758<br />

Property — 11,891<br />

At 31 December 150,637 148,483<br />

Included in equities are 1,295,000 (2014: 2,000,000) ordinary 10p shares in Henry Boot PLC with a value at the year end of<br />

£2,900,800 (2014: £3,905,000).<br />

The weighted average duration of the defined benefit obligation is 15.9 years (2014: 16.5 years).<br />

The current estimated amount of total contributions expected to be paid to the scheme during the 2015 financial year is<br />

£4,909,000, being £4,907,000 payable by the Group and £2,000 payable by scheme members.<br />

The Company’s level of recovery plan funding to the scheme is £3,775,000 per annum, which will be reviewed at the next triennial<br />

valuation. In addition to this the Company contributes a further £250,000 per annum towards the administration expenses of the<br />

scheme.<br />

28. Operating leases<br />

The Group as lessee<br />

Minimum lease payments under operating leases recognised in the Statement of Comprehensive Income for<br />

the year 276 239<br />

2015<br />

£’000<br />

At 31 December 2015, the Group had outstanding commitments for future aggregate minimum lease payments under noncancellable<br />

operating leases which fall due as follows:<br />

Within one year 255 150<br />

In the second to fifth years inclusive 586 508<br />

After five years 440 550<br />

1,281 1,208<br />

2015<br />

£’000<br />

2014<br />

£’000<br />

2014<br />

£’000<br />

126