Cohesive Consistent Confident

4mZ0Bv

4mZ0Bv

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Henry Boot PLC<br />

Annual Report and Financial Statements for the year ended 31 December 2015<br />

www.henryboot.co.uk<br />

Stock Code: BHY<br />

Long-term<br />

Financial Strength<br />

Talented<br />

People<br />

Responsible<br />

Practices<br />

We have long-established<br />

relationships with our key funding<br />

partners, Barclays Bank PLC, The<br />

Royal Bank of Scotland plc and<br />

Santander UK plc. We maintain<br />

headroom within our three-year<br />

banking facilities, renewed from<br />

February 2015, and consider our<br />

property investment portfolio as<br />

a ‘store of value’ to be realised to<br />

augment these facilities if required.<br />

The land bank and development<br />

opportunities, together with the<br />

investment portfolio, have been<br />

acquired largely from retained<br />

resources ensuring our gearing levels<br />

are prudent. In the longer term we<br />

aim to achieve a healthy return on<br />

capital employed and dividend cover<br />

for reinvestment in our core activities<br />

which, in turn, creates improving<br />

longer-term shareholder returns.<br />

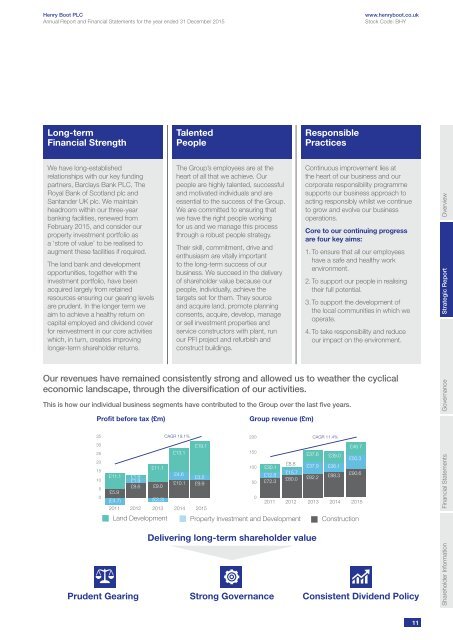

Our revenues have remained consistently strong and allowed us to weather the cyclical<br />

economic landscape, through the diversification of our activities.<br />

This is how our individual business segments have contributed to the Group over the last five years.<br />

Profit before tax (£m)<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

£11.1<br />

£5.9<br />

(£4.7)<br />

2011<br />

£1.9<br />

£1.9<br />

£8.6<br />

2012<br />

£11.1<br />

£9.0<br />

(£2.3)<br />

2013<br />

The Group’s employees are at the<br />

heart of all that we achieve. Our<br />

people are highly talented, successful<br />

and motivated individuals and are<br />

essential to the success of the Group.<br />

We are committed to ensuring that<br />

we have the right people working<br />

for us and we manage this process<br />

through a robust people strategy.<br />

Their skill, commitment, drive and<br />

enthusiasm are vitally important<br />

to the long-term success of our<br />

business. We succeed in the delivery<br />

of shareholder value because our<br />

people, individually, achieve the<br />

targets set for them. They source<br />

and acquire land, promote planning<br />

consents, acquire, develop, manage<br />

or sell investment properties and<br />

service constructors with plant, run<br />

our PFI project and refurbish and<br />

construct buildings.<br />

CAGR 19.1%<br />

£13.1<br />

£4.6<br />

£10.1<br />

2014<br />

£19.1<br />

£3.5<br />

£9.9<br />

2015<br />

Group revenue (£m)<br />

200<br />

150<br />

100<br />

50<br />

0<br />

£30.1<br />

£12.8<br />

£72.3<br />

2011<br />

£8.8<br />

£15.7<br />

£80.0<br />

2012<br />

£37.6<br />

£37.9<br />

£82.2<br />

CAGR 11.4%<br />

2013<br />

Delivering long-term shareholder value<br />

Continuous improvement lies at<br />

the heart of our business and our<br />

corporate responsibility programme<br />

supports our business approach to<br />

acting responsibly whilst we continue<br />

to grow and evolve our business<br />

operations.<br />

Core to our continuing progress<br />

are four key aims:<br />

1. To ensure that all our employees<br />

have a safe and healthy work<br />

environment.<br />

2. To support our people in realising<br />

their full potential.<br />

3. To support the development of<br />

the local communities in which we<br />

operate.<br />

4. To take responsibility and reduce<br />

our impact on the environment.<br />

Prudent Gearing Strong Governance <strong>Consistent</strong> Dividend Policy<br />

£39.0<br />

£26.1<br />

£88.3<br />

Land Development Property Investment and Development Construction<br />

2014<br />

£46.7<br />

£50.3<br />

£90.6<br />

2015<br />

Shareholder Information Financial Statements<br />

Governance<br />

Strategic Report<br />

Overview<br />

11