Emerging Trends and Challenges

FTPartnersResearch-GlobalMoneyTransferTrends

FTPartnersResearch-GlobalMoneyTransferTrends

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

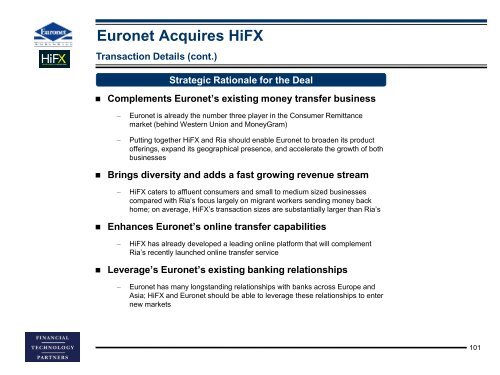

Euronet Acquires HiFX<br />

Transaction Details (cont.)<br />

Strategic Rationale for the Deal<br />

• Complements Euronet’s existing money transfer business<br />

– Euronet is already the number three player in the Consumer Remittance<br />

market (behind Western Union <strong>and</strong> MoneyGram)<br />

– Putting together HiFX <strong>and</strong> Ria should enable Euronet to broaden its product<br />

offerings, exp<strong>and</strong> its geographical presence, <strong>and</strong> accelerate the growth of both<br />

businesses<br />

• Brings diversity <strong>and</strong> adds a fast growing revenue stream<br />

– HiFX caters to affluent consumers <strong>and</strong> small to medium sized businesses<br />

compared with Ria’s focus largely on migrant workers sending money back<br />

home; on average, HiFX’s transaction sizes are substantially larger than Ria’s<br />

• Enhances Euronet’s online transfer capabilities<br />

– HiFX has already developed a leading online platform that will complement<br />

Ria’s recently launched online transfer service<br />

• Leverage’s Euronet’s existing banking relationships<br />

– Euronet has many longst<strong>and</strong>ing relationships with banks across Europe <strong>and</strong><br />

Asia; HiFX <strong>and</strong> Euronet should be able to leverage these relationships to enter<br />

new markets<br />

101