ANNUAL%20REPORT%202015%20eng

ANNUAL%20REPORT%202015%20eng

ANNUAL%20REPORT%202015%20eng

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to Consolidated Financial Statements<br />

6 LOSS BEFORE TAXATION (Continued)<br />

(c)<br />

Other items: (Continued)<br />

Note: (Continued)<br />

(ii)<br />

Impairment of non-financial assets (Continued)<br />

– Discount rate<br />

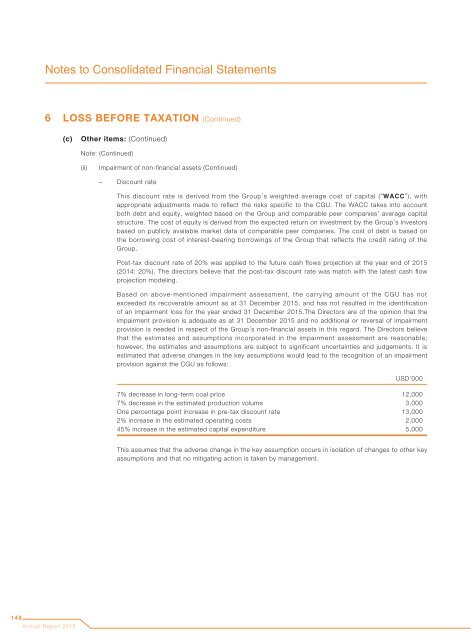

This discount rate is derived from the Group’s weighted average cost of capital (“WACC”), with<br />

appropriate adjustments made to reflect the risks specific to the CGU. The WACC takes into account<br />

both debt and equity, weighted based on the Group and comparable peer companies’ average capital<br />

structure. The cost of equity is derived from the expected return on investment by the Group’s investors<br />

based on publicly available market data of comparable peer companies. The cost of debt is based on<br />

the borrowing cost of interest-bearing borrowings of the Group that reflects the credit rating of the<br />

Group.<br />

Post-tax discount rate of 20% was applied to the future cash flows projection at the year end of 2015<br />

(2014: 20%). The directors believe that the post-tax discount rate was match with the latest cash flow<br />

projection modeling.<br />

Based on above-mentioned impairment assessment, the carrying amount of the CGU has not<br />

exceeded its recoverable amount as at 31 December 2015, and has not resulted in the identification<br />

of an impairment loss for the year ended 31 December 2015.The Directors are of the opinion that the<br />

impairment provision is adequate as at 31 December 2015 and no additional or reversal of impairment<br />

provision is needed in respect of the Group’s non-financial assets in this regard. The Directors believe<br />

that the estimates and assumptions incorporated in the impairment assessment are reasonable;<br />

however, the estimates and assumptions are subject to significant uncertainties and judgements. It is<br />

estimated that adverse changes in the key assumptions would lead to the recognition of an impairment<br />

provision against the CGU as follows:<br />

USD’000<br />

7% decrease in long-term coal price 12,000<br />

7% decrease in the estimated production volume 3,000<br />

One percentage point increase in pre-tax discount rate 13,000<br />

2% increase in the estimated operating costs 2,000<br />

45% increase in the estimated capital expenditure 5,000<br />

This assumes that the adverse change in the key assumption occurs in isolation of changes to other key<br />

assumptions and that no mitigating action is taken by management.<br />

148<br />

Annual Report 2015