ANNUAL%20REPORT%202015%20eng

ANNUAL%20REPORT%202015%20eng

ANNUAL%20REPORT%202015%20eng

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

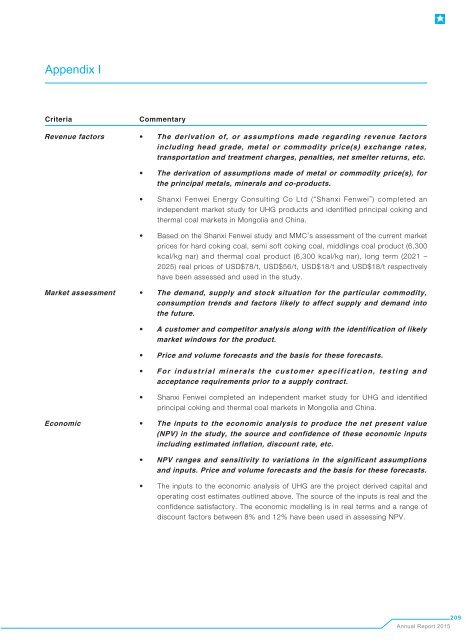

Appendix I<br />

Criteria<br />

Commentary<br />

Revenue factors • The derivation of, or assumptions made regarding revenue factors<br />

including head grade, metal or commodity price(s) exchange rates,<br />

transportation and treatment charges, penalties, net smelter returns, etc.<br />

• The derivation of assumptions made of metal or commodity price(s), for<br />

the principal metals, minerals and co-products.<br />

• Shanxi Fenwei Energy Consulting Co Ltd (“Shanxi Fenwei”) completed an<br />

independent market study for UHG products and identified principal coking and<br />

thermal coal markets in Mongolia and China.<br />

• Based on the Shanxi Fenwei study and MMC’s assessment of the current market<br />

prices for hard coking coal, semi soft coking coal, middlings coal product (6,300<br />

kcal/kg nar) and thermal coal product (6,300 kcal/kg nar), long term (2021 –<br />

2025) real prices of USD$78/t, USD$56/t, USD$18/t and USD$18/t respectively<br />

have been assessed and used in the study.<br />

Market assessment • The demand, supply and stock situation for the particular commodity,<br />

consumption trends and factors likely to affect supply and demand into<br />

the future.<br />

• A customer and competitor analysis along with the identification of likely<br />

market windows for the product.<br />

• Price and volume forecasts and the basis for these forecasts.<br />

• For industrial minerals the customer specification, testing and<br />

acceptance requirements prior to a supply contract.<br />

• Shanxi Fenwei completed an independent market study for UHG and identified<br />

principal coking and thermal coal markets in Mongolia and China.<br />

Economic • The inputs to the economic analysis to produce the net present value<br />

(NPV) in the study, the source and confidence of these economic inputs<br />

including estimated inflation, discount rate, etc.<br />

• NPV ranges and sensitivity to variations in the significant assumptions<br />

and inputs. Price and volume forecasts and the basis for these forecasts.<br />

• The inputs to the economic analysis of UHG are the project derived capital and<br />

operating cost estimates outlined above. The source of the inputs is real and the<br />

confidence satisfactory. The economic modelling is in real terms and a range of<br />

discount factors between 8% and 12% have been used in assessing NPV.<br />

Annual Report 2015<br />

209