Hydrocarbon Vision 2030 (ஹைட்ரோகார்பன் தொலைநோக்கு ஆவணம் 2030)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Existing LPG connections in Northeast India<br />

4<br />

The Northeast has only 57.45 lakh LPG connections compared with the national figure of 1,910 lakh.<br />

However, as per ‘PAHAL-Direct Benefits Transfer for LPG (DBTL) Consumers Scheme’ the overall<br />

connection figure is around 14.25 crore (as per August 2015 data). As per IOCL’s estimates, the DBTL<br />

scheme covers almost 82% of all connections. Therefore, the total number of active connections is<br />

estimated to be at 17 crore. Further, the growth rate of LPG connections in the Northeast matches the<br />

national growth rate. The table below provides details of LPG connection in northeast India in the last<br />

decade.<br />

5<br />

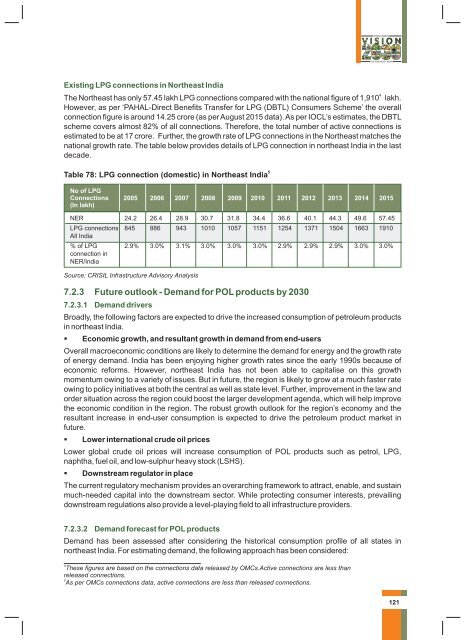

Table 78: LPG connection (domestic) in Northeast India<br />

No of LPG<br />

Connections<br />

(In lakh)<br />

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015<br />

NER 24.2 26.4 28.9 30.7 31.8 34.4 36.6 40.1 44.3 49.6 57.45<br />

LPG connections 845 886 943 1010 1057 1151 1254 1371 1504 1663 1910<br />

All India<br />

% of LPG 2.9% 3.0% 3.1% 3.0% 3.0% 3.0% 2.9% 2.9% 2.9% 3.0% 3.0%<br />

connection in<br />

NER/India<br />

Source: CRISIL Infrastructure Advisory Analysis<br />

7.2.3 Future outlook - Demand for POL products by <strong>2030</strong><br />

7.2.3.1 Demand drivers<br />

Broadly, the following factors are expected to drive the increased consumption of petroleum products<br />

in northeast India.<br />

Economic growth, and resultant growth in demand from end-users<br />

Overall macroeconomic conditions are likely to determine the demand for energy and the growth rate<br />

of energy demand. India has been enjoying higher growth rates since the early 1990s because of<br />

economic reforms. However, northeast India has not been able to capitalise on this growth<br />

momentum owing to a variety of issues. But in future, the region is likely to grow at a much faster rate<br />

owing to policy initiatives at both the central as well as state level. Further, improvement in the law and<br />

order situation across the region could boost the larger development agenda, which will help improve<br />

the economic condition in the region. The robust growth outlook for the region’s economy and the<br />

resultant increase in end-user consumption is expected to drive the petroleum product market in<br />

future.<br />

Lower international crude oil prices<br />

Lower global crude oil prices will increase consumption of POL products such as petrol, LPG,<br />

naphtha, fuel oil, and low-sulphur heavy stock (LSHS).<br />

Downstream regulator in place<br />

The current regulatory mechanism provides an overarching framework to attract, enable, and sustain<br />

much-needed capital into the downstream sector. While protecting consumer interests, prevailing<br />

downstream regulations also provide a level-playing field to all infrastructure providers.<br />

7.2.3.2 Demand forecast for POL products<br />

Demand has been assessed after considering the historical consumption profile of all states in<br />

northeast India. For estimating demand, the following approach has been considered:<br />

4<br />

These figures are based on the connections data released by OMCs.Active connections are less than<br />

released connections.<br />

5<br />

As per OMCs connections data, active connections are less than released connections.<br />

121