Hydrocarbon Vision 2030 (ஹைட்ரோகார்பன் தொலைநோக்கு ஆவணம் 2030)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

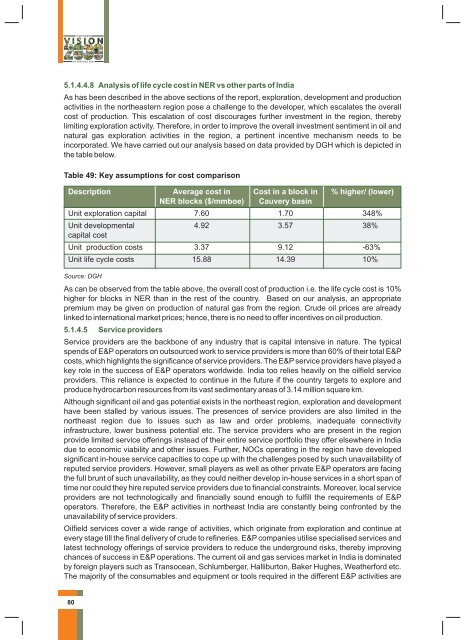

5.1.4.4.8 Analysis of life cycle cost in NER vs other parts of India<br />

As has been described in the above sections of the report, exploration, development and production<br />

activities in the northeastern region pose a challenge to the developer, which escalates the overall<br />

cost of production. This escalation of cost discourages further investment in the region, thereby<br />

limiting exploration activity. Therefore, in order to improve the overall investment sentiment in oil and<br />

natural gas exploration activities in the region, a pertinent incentive mechanism needs to be<br />

incorporated. We have carried out our analysis based on data provided by DGH which is depicted in<br />

the table below.<br />

Table 49: Key assumptions for cost comparison<br />

Description Average cost in Cost in a block in % higher/ (lower)<br />

NER blocks ($/mmboe) Cauvery basin<br />

Unit exploration capital 7.60 1.70 348%<br />

Unit developmental 4.92 3.57 38%<br />

capital cost<br />

Unit production costs 3.37 9.12 -63%<br />

Unit life cycle costs 15.88 14.39 10%<br />

Source: DGH<br />

As can be observed from the table above, the overall cost of production i.e. the life cycle cost is 10%<br />

higher for blocks in NER than in the rest of the country. Based on our analysis, an appropriate<br />

premium may be given on production of natural gas from the region. Crude oil prices are already<br />

linked to international market prices; hence, there is no need to offer incentives on oil production.<br />

5.1.4.5 Service providers<br />

Service providers are the backbone of any industry that is capital intensive in nature. The typical<br />

spends of E&P operators on outsourced work to service providers is more than 60% of their total E&P<br />

costs, which highlights the significance of service providers. The E&P service providers have played a<br />

key role in the success of E&P operators worldwide. India too relies heavily on the oilfield service<br />

providers. This reliance is expected to continue in the future if the country targets to explore and<br />

produce hydrocarbon resources from its vast sedimentary areas of 3.14 million square km.<br />

Although significant oil and gas potential exists in the northeast region, exploration and development<br />

have been stalled by various issues. The presences of service providers are also limited in the<br />

northeast region due to issues such as law and order problems, inadequate connectivity<br />

infrastructure, lower business potential etc. The service providers who are present in the region<br />

provide limited service offerings instead of their entire service portfolio they offer elsewhere in India<br />

due to economic viability and other issues. Further, NOCs operating in the region have developed<br />

significant in-house service capacities to cope up with the challenges posed by such unavailability of<br />

reputed service providers. However, small players as well as other private E&P operators are facing<br />

the full brunt of such unavailability, as they could neither develop in-house services in a short span of<br />

time nor could they hire reputed service providers due to financial constraints. Moreover, local service<br />

providers are not technologically and financially sound enough to fulfill the requirements of E&P<br />

operators. Therefore, the E&P activities in northeast India are constantly being confronted by the<br />

unavailability of service providers.<br />

Oilfield services cover a wide range of activities, which originate from exploration and continue at<br />

every stage till the final delivery of crude to refineries. E&P companies utilise specialised services and<br />

latest technology offerings of service providers to reduce the underground risks, thereby improving<br />

chances of success in E&P operations. The current oil and gas services market in India is dominated<br />

by foreign players such as Transocean, Schlumberger, Halliburton, Baker Hughes, Weatherford etc.<br />

The majority of the consumables and equipment or tools required in the different E&P activities are<br />

80