Hydrocarbon Vision 2030 (ஹைட்ரோகார்பன் தொலைநோக்கு ஆவணம் 2030)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Lower volatility in gas prices vis-à-vis alternate liquid fuels<br />

Volatility in crude oil prices over the past few years has translated into price variability of alternate<br />

liquid fuels such as petrol, LPG, naphtha, fuel oil, and low-sulphur heavy stock (LSHS). In<br />

comparison, natural gas prices have been less volatile in India. Petroleum product prices are highly<br />

correlated to the dynamics of the crude oil market, whereas natural gas prices (across sources) in<br />

India have so far been set on a long-term basis, thereby making them less volatile.<br />

Downstream regulator in place<br />

The current regulatory mechanism provides an overarching framework to attract, enable, and sustain<br />

the much-needed capital into the natural gas downstream sector. While protecting consumer interest,<br />

prevailing downstream regulations also provide a level playing field to all infrastructure providers.<br />

Environmental concerns<br />

Globally, reduction in carbon emission has emerged as a key concern area. As natural gas is a<br />

cleaner and environmental friendly fuel (lower carbon emissions per unit energy generated), it is<br />

being promoted globally across key end-use segments, such as power generation, and also as<br />

industrial and auto fuel. End-users of natural gas are entitled to certified emission reduction credits<br />

and can, therefore, gain financially from such projects/transactions.<br />

7.3.2.2 Demand from CGD sector<br />

Gas demand from the city-gas distribution (CGD) sector has been estimated for existing cities and<br />

new demand from other cities has been arrived at after duly considering the likely timeframe within<br />

which cities/districts will receive pipeline connectivity. Existing CGD entities include cities that are<br />

deemed authorised, i.e., AGCL and TNGCL. Gas demand from these entities was at 0.68 MMSCMD<br />

in 2014-15 and is expected to reach 4.4 MMSCMD by 2029-30 assuming that phases 1, 2 and phase<br />

3 of the gas pipeline are connected and spur lines within districts are implemented. Districts<br />

considered in each phase are:<br />

Phase - 1: Morigaon, Nagaon<br />

Phase 2: Guwahati, Silchar (Cachar Hills), Aizawl, Imphal, Kamrup, Shillong, Karimganj,<br />

Hailakandi, Goalpara, Bongaigaon<br />

Phase 3: Bongaigaon, Dhubri, Kokrajhar<br />

The following assumptions have been considered for estimating CGD demand:<br />

Each family consists of five members and consumption per family is 0.5 SCM gas per annum<br />

Maximum conversion of 65-70% has been considered for all categories (domestic, commercial,<br />

CNG and industrial).<br />

Implementation has been considered in phases in all categories.<br />

Discount of 50% for CNG consumption and 80% for industrial consumption have been<br />

considered as per for all-India pattern for CNG and PNG.<br />

The demand from CGDs is given below.<br />

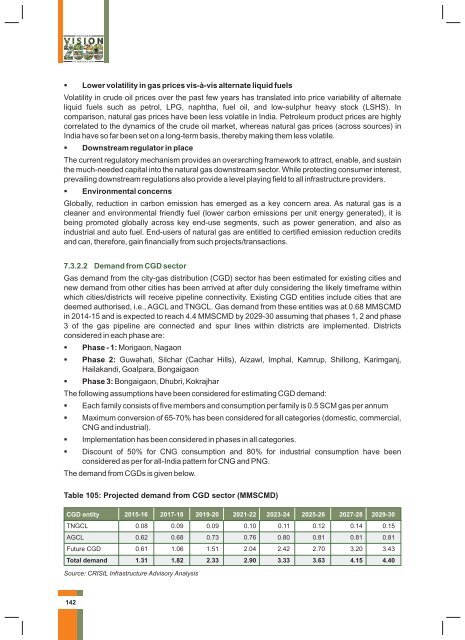

Table 105: Projected demand from CGD sector (MMSCMD)<br />

CGD entity 2015-16 2017-18 2019-20 2021-22 2023-24 2025-26 2027-28 2029-30<br />

TNGCL 0.08 0.09 0.09 0.10 0.11 0.12 0.14 0.15<br />

AGCL 0.62 0.68 0.73 0.76 0.80 0.81 0.81 0.81<br />

Future CGD 0.61 1.06 1.51 2.04 2.42 2.70 3.20 3.43<br />

Total demand 1.31 1.82 2.33 2.90 3.33 3.63 4.15 4.40<br />

Source: CRISIL Infrastructure Advisory Analysis<br />

142