Hydrocarbon Vision 2030 (ஹைட்ரோகார்பன் தொலைநோக்கு ஆவணம் 2030)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

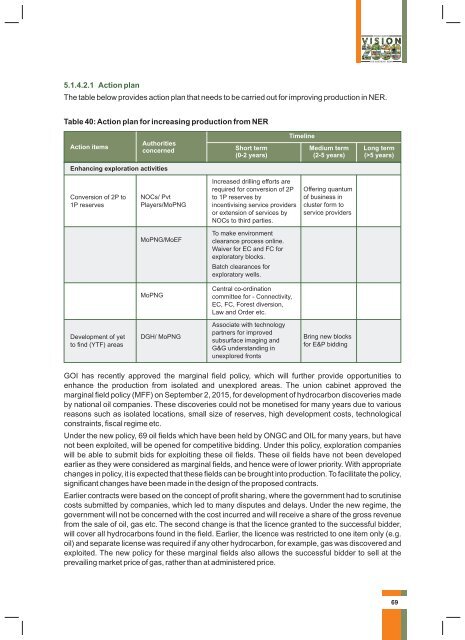

5.1.4.2.1 Action plan<br />

The table below provides action plan that needs to be carried out for improving production in NER.<br />

Table 40: Action plan for increasing production from NER<br />

Action items<br />

Authorities<br />

concerned<br />

Short term<br />

(0-2 years)<br />

Timeline<br />

Medium term<br />

(2-5 years)<br />

Long term<br />

(>5 years)<br />

Enhancing exploration activities<br />

Conversion of 2P to<br />

1P reserves<br />

NOCs/ Pvt<br />

Players/MoPNG<br />

Increased drilling efforts are<br />

required for conversion of 2P<br />

to 1P reserves by<br />

incentivising service providers<br />

or extension of services by<br />

NOCs to third parties.<br />

Offering quantum<br />

of business in<br />

cluster form to<br />

service providers<br />

MoPNG/MoEF<br />

To make environment<br />

clearance process online.<br />

Waiver for EC and FC for<br />

exploratory blocks.<br />

Batch clearances for<br />

exploratory wells.<br />

MoPNG<br />

Central co-ordination<br />

committee for - Connectivity,<br />

EC, FC, Forest diversion,<br />

Law and Order etc.<br />

Development of yet<br />

to find (YTF) areas<br />

DGH/ MoPNG<br />

Associate with technology<br />

partners for improved<br />

subsurface imaging and<br />

G&G understanding in<br />

unexplored fronts<br />

Bring new blocks<br />

for E&P bidding<br />

GOI has recently approved the marginal field policy, which will further provide opportunities to<br />

enhance the production from isolated and unexplored areas. The union cabinet approved the<br />

marginal field policy (MFF) on September 2, 2015, for development of hydrocarbon discoveries made<br />

by national oil companies. These discoveries could not be monetised for many years due to various<br />

reasons such as isolated locations, small size of reserves, high development costs, technological<br />

constraints, fiscal regime etc.<br />

Under the new policy, 69 oil fields which have been held by ONGC and OIL for many years, but have<br />

not been exploited, will be opened for competitive bidding. Under this policy, exploration companies<br />

will be able to submit bids for exploiting these oil fields. These oil fields have not been developed<br />

earlier as they were considered as marginal fields, and hence were of lower priority. With appropriate<br />

changes in policy, it is expected that these fields can be brought into production. To facilitate the policy,<br />

significant changes have been made in the design of the proposed contracts.<br />

Earlier contracts were based on the concept of profit sharing, where the government had to scrutinise<br />

costs submitted by companies, which led to many disputes and delays. Under the new regime, the<br />

government will not be concerned with the cost incurred and will receive a share of the gross revenue<br />

from the sale of oil, gas etc. The second change is that the licence granted to the successful bidder,<br />

will cover all hydrocarbons found in the field. Earlier, the licence was restricted to one item only (e.g.<br />

oil) and separate license was required if any other hydrocarbon, for example, gas was discovered and<br />

exploited. The new policy for these marginal fields also allows the successful bidder to sell at the<br />

prevailing market price of gas, rather than at administered price.<br />

69