Hydrocarbon Vision 2030 (ஹைட்ரோகார்பன் தொலைநோக்கு ஆவணம் 2030)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

11.4 Bhutan<br />

Bhutan has no natural petroleum or natural gas reserves. The kingdom has some 1.3 million tonnes of<br />

coal reserves, but extracts only about 1,000 tonnes of coal annually, entirely for domestic<br />

consumption. Bhutan also imports 1,000 BPD of oil. Majority of the oil import is for automobiles.<br />

In the early 21st century, households comprised about 70% of Bhutan’s energy consumption. Lately,<br />

heating and cooking with firewood, in particular, accounted for 70-90% of total energy consumption<br />

and virtually 100% of household energy consumption. In contrast, commercial activities in Bhutan are<br />

fueled mostly by hydroelectricity (about 97%), some fossil fuel-based thermal power (about 3%), and<br />

a minimal amount of other fossil fuels. As a result, Bhutan sells much of its hydroelectricity to India<br />

during the summer months.<br />

This also presents a potential for petroleum products by replacing firewood with petroleum products.<br />

11.5 Sri Lanka<br />

11.5.1 Refining capacity<br />

The domestic oil & gas industry is small, with no hydrocarbon production, despite a refinery at<br />

Sapugaskanda with a processing capacity of 50,000 BPD or 2 MMTPA. The Sri Lankan government<br />

has been considering setting up another refinery, and looking at expressions of interest from various<br />

countries. IOCL, which is present in Sri Lanka through its subsidiary Lanka IOC, has come forward to<br />

set up the refinery in a joint venture with the Sri Lankan government. Considering Sri Lanka’s fuel<br />

consumption targets for 2020 and <strong>2030</strong>, IOCL may look at a capacity addition of 5-9 MMTPA.<br />

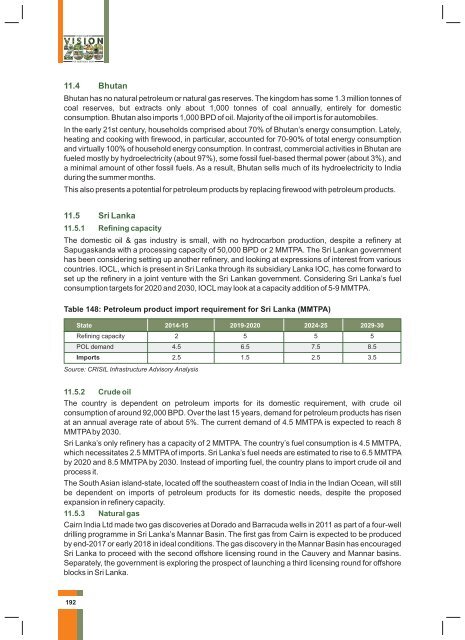

Table 148: Petroleum product import requirement for Sri Lanka (MMTPA)<br />

State 2014-15 2019-2020 2024-25 2029-30<br />

Refining capacity 2 5 5 5<br />

POL demand 4.5 6.5 7.5 8.5<br />

Imports 2.5 1.5 2.5 3.5<br />

Source: CRISIL Infrastructure Advisory Analysis<br />

11.5.2 Crude oil<br />

The country is dependent on petroleum imports for its domestic requirement, with crude oil<br />

consumption of around 92,000 BPD. Over the last 15 years, demand for petroleum products has risen<br />

at an annual average rate of about 5%. The current demand of 4.5 MMTPA is expected to reach 8<br />

MMTPA by <strong>2030</strong>.<br />

Sri Lanka’s only refinery has a capacity of 2 MMTPA. The country’s fuel consumption is 4.5 MMTPA,<br />

which necessitates 2.5 MMTPA of imports. Sri Lanka’s fuel needs are estimated to rise to 6.5 MMTPA<br />

by 2020 and 8.5 MMTPA by <strong>2030</strong>. Instead of importing fuel, the country plans to import crude oil and<br />

process it.<br />

The South Asian island-state, located off the southeastern coast of India in the Indian Ocean, will still<br />

be dependent on imports of petroleum products for its domestic needs, despite the proposed<br />

expansion in refinery capacity.<br />

11.5.3 Natural gas<br />

Cairn India Ltd made two gas discoveries at Dorado and Barracuda wells in 2011 as part of a four-well<br />

drilling programme in Sri Lanka’s Mannar Basin. The first gas from Cairn is expected to be produced<br />

by end-2017 or early 2018 in ideal conditions. The gas discovery in the Mannar Basin has encouraged<br />

Sri Lanka to proceed with the second offshore licensing round in the Cauvery and Mannar basins.<br />

Separately, the government is exploring the prospect of launching a third licensing round for offshore<br />

blocks in Sri Lanka.<br />

192