The 3Dimensional Trading Breakthrough

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Brian Schad<br />

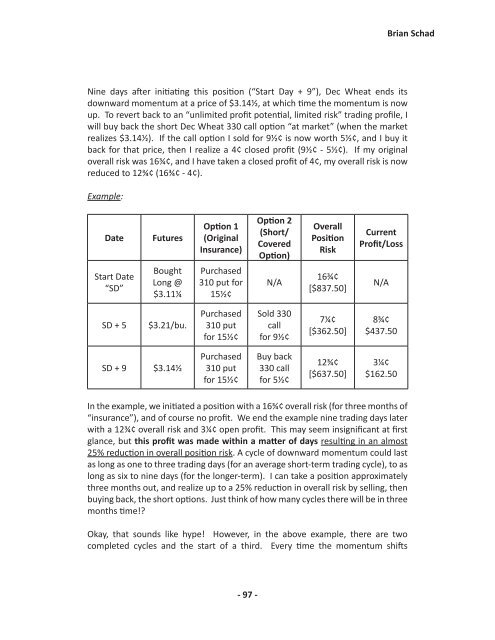

Nine days after initiating this position (“Start Day + 9”), Dec Wheat ends its<br />

downward momentum at a price of $3.14½, at which time the momentum is now<br />

up. To revert back to an “unlimited profit potential, limited risk” trading profile, I<br />

will buy back the short Dec Wheat 330 call option “at market” (when the market<br />

realizes $3.14½). If the call option I sold for 9½¢ is now worth 5½¢, and I buy it<br />

back for that price, then I realize a 4¢ closed profit (9½¢ - 5½¢). If my original<br />

overall risk was 16¾¢, and I have taken a closed profit of 4¢, my overall risk is now<br />

reduced to 12¾¢ (16¾¢ - 4¢).<br />

Example:<br />

Date<br />

Futures<br />

Option 1<br />

(Original<br />

Insurance)<br />

Option 2<br />

(Short/<br />

Covered<br />

Option)<br />

Overall<br />

Position<br />

Risk<br />

Current<br />

Profit/Loss<br />

Start Date<br />

“SD”<br />

Bought<br />

Long @<br />

$3.11¼<br />

Purchased<br />

310 put for<br />

15½¢<br />

N/A<br />

16¾¢<br />

[$837.50]<br />

N/A<br />

SD + 5<br />

$3.21/bu.<br />

Purchased<br />

310 put<br />

for 15½¢<br />

Sold 330<br />

call<br />

for 9½¢<br />

7¼¢<br />

[$362.50]<br />

8¾¢<br />

$437.50<br />

SD + 9<br />

$3.14½<br />

Purchased<br />

310 put<br />

for 15½¢<br />

Buy back<br />

330 call<br />

for 5½¢<br />

12¾¢<br />

[$637.50]<br />

3¼¢<br />

$162.50<br />

In the example, we initiated a position with a 16¾¢ overall risk (for three months of<br />

“insurance”), and of course no profit. We end the example nine trading days later<br />

with a 12¾¢ overall risk and 3¼¢ open profit. This may seem insignificant at first<br />

glance, but this profit was made within a matter of days resulting in an almost<br />

25% reduction in overall position risk. A cycle of downward momentum could last<br />

as long as one to three trading days (for an average short-term trading cycle), to as<br />

long as six to nine days (for the longer-term). I can take a position approximately<br />

three months out, and realize up to a 25% reduction in overall risk by selling, then<br />

buying back, the short options. Just think of how many cycles there will be in three<br />

months time!?<br />

Okay, that sounds like hype! However, in the above example, there are two<br />

completed cycles and the start of a third. Every time the momentum shifts<br />

- 97 -