The 3Dimensional Trading Breakthrough

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Brian Schad<br />

<strong>The</strong> Problem with Protective Stops<br />

Having “protective stops” working in the market for your long/short futures position<br />

doesn’t cut it with today’s volatility! Besides that, all markets are “trending”<br />

towards trading around the clock (as of this writing, New York soft’s markets have<br />

just eliminated day pit-session trading. Only electronic trading going forward).<br />

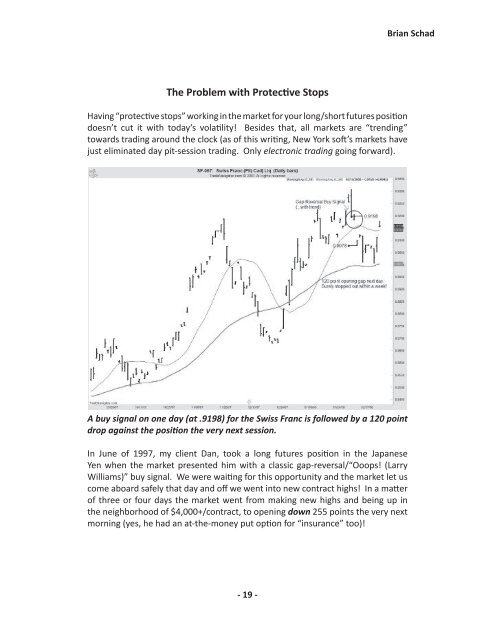

A buy signal on one day (at .9198) for the Swiss Franc is followed by a 120 point<br />

drop against the position the very next session.<br />

In June of 1997, my client Dan, took a long futures position in the Japanese<br />

Yen when the market presented him with a classic gap-reversal/“Ooops! (Larry<br />

Williams)” buy signal. We were waiting for this opportunity and the market let us<br />

come aboard safely that day and off we went into new contract highs! In a matter<br />

of three or four days the market went from making new highs and being up in<br />

the neighborhood of $4,000+/contract, to opening down 255 points the very next<br />

morning (yes, he had an at-the-money put option for “insurance” too)!<br />

- 19 -