The 3Dimensional Trading Breakthrough

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>The</strong> 3 Dimensional <strong>Trading</strong> <strong>Breakthrough</strong><br />

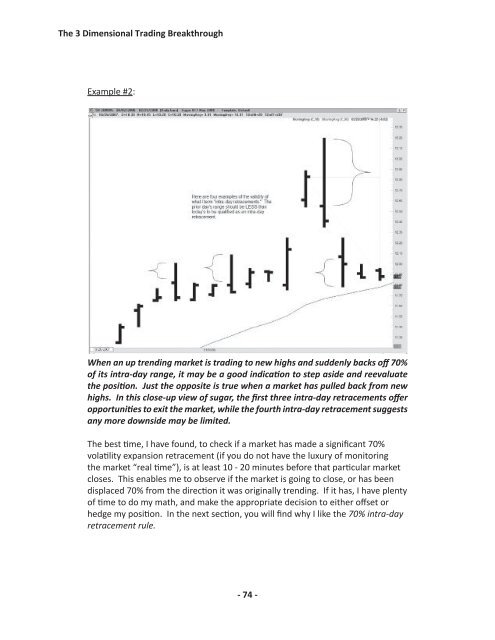

Example #2:<br />

When an up trending market is trading to new highs and suddenly backs off 70%<br />

of its intra-day range, it may be a good indication to step aside and reevaluate<br />

the position. Just the opposite is true when a market has pulled back from new<br />

highs. In this close-up view of sugar, the first three intra-day retracements offer<br />

opportunities to exit the market, while the fourth intra-day retracement suggests<br />

any more downside may be limited.<br />

<strong>The</strong> best time, I have found, to check if a market has made a significant 70%<br />

volatility expansion retracement (if you do not have the luxury of monitoring<br />

the market “real time”), is at least 10 - 20 minutes before that particular market<br />

closes. This enables me to observe if the market is going to close, or has been<br />

displaced 70% from the direction it was originally trending. If it has, I have plenty<br />

of time to do my math, and make the appropriate decision to either offset or<br />

hedge my position. In the next section, you will find why I like the 70% intra-day<br />

retracement rule.<br />

- 74 -