The 3Dimensional Trading Breakthrough

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>The</strong> 3 Dimensional <strong>Trading</strong> <strong>Breakthrough</strong><br />

Types of Indicators<br />

<strong>The</strong>re are two types of indicators that most traders usually consider in their dayto-day<br />

trading activity: “external” and “internal” indicators. First, let’s talk about<br />

external indicators.<br />

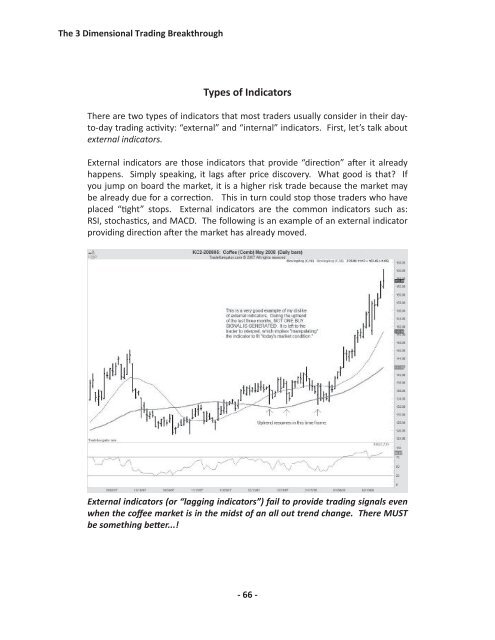

External indicators are those indicators that provide “direction” after it already<br />

happens. Simply speaking, it lags after price discovery. What good is that? If<br />

you jump on board the market, it is a higher risk trade because the market may<br />

be already due for a correction. This in turn could stop those traders who have<br />

placed “tight” stops. External indicators are the common indicators such as:<br />

RSI, stochastics, and MACD. <strong>The</strong> following is an example of an external indicator<br />

providing direction after the market has already moved.<br />

External indicators (or “lagging indicators”) fail to provide trading signals even<br />

when the coffee market is in the midst of an all out trend change. <strong>The</strong>re MUST<br />

be something better...!<br />

- 66 -