The 3Dimensional Trading Breakthrough

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Brian Schad<br />

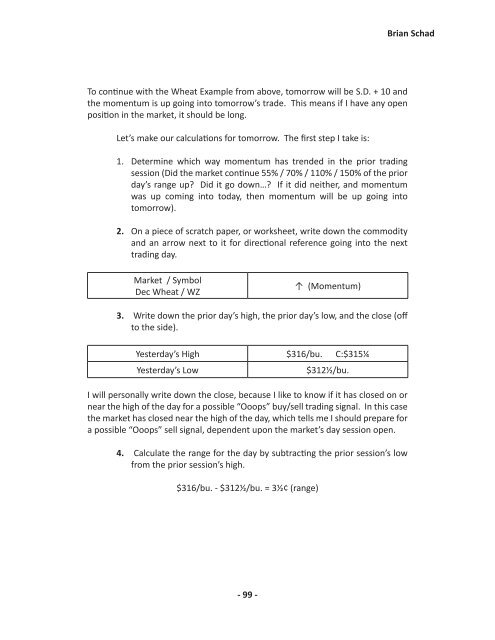

To continue with the Wheat Example from above, tomorrow will be S.D. + 10 and<br />

the momentum is up going into tomorrow’s trade. This means if I have any open<br />

position in the market, it should be long.<br />

Let’s make our calculations for tomorrow. <strong>The</strong> first step I take is:<br />

1. Determine which way momentum has trended in the prior trading<br />

session (Did the market continue 55% / 70% / 110% / 150% of the prior<br />

day’s range up? Did it go down…? If it did neither, and momentum<br />

was up coming into today, then momentum will be up going into<br />

tomorrow).<br />

2. On a piece of scratch paper, or worksheet, write down the commodity<br />

and an arrow next to it for directional reference going into the next<br />

trading day.<br />

Market / Symbol<br />

Dec Wheat / WZ<br />

↑ (Momentum)<br />

3. Write down the prior day’s high, the prior day’s low, and the close (off<br />

to the side).<br />

Yesterday’s High $316/bu. C:$315¼<br />

Yesterday’s Low<br />

$312½/bu.<br />

I will personally write down the close, because I like to know if it has closed on or<br />

near the high of the day for a possible “Ooops” buy/sell trading signal. In this case<br />

the market has closed near the high of the day, which tells me I should prepare for<br />

a possible “Ooops” sell signal, dependent upon the market’s day session open.<br />

4. Calculate the range for the day by subtracting the prior session’s low<br />

from the prior session’s high.<br />

$316/bu. - $312½/bu. = 3½¢ (range)<br />

- 99 -