The 3Dimensional Trading Breakthrough

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>The</strong> 3 Dimensional <strong>Trading</strong> <strong>Breakthrough</strong><br />

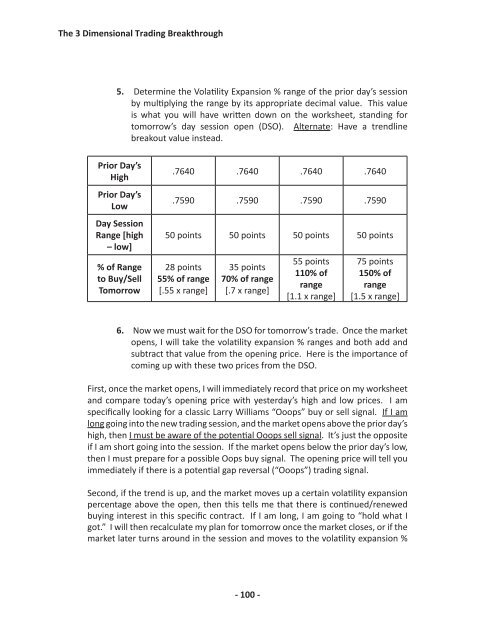

5. Determine the Volatility Expansion % range of the prior day’s session<br />

by multiplying the range by its appropriate decimal value. This value<br />

is what you will have written down on the worksheet, standing for<br />

tomorrow’s day session open (DSO). Alternate: Have a trendline<br />

breakout value instead.<br />

Prior Day’s<br />

High<br />

Prior Day’s<br />

Low<br />

Day Session<br />

Range [high<br />

– low]<br />

% of Range<br />

to Buy/Sell<br />

Tomorrow<br />

.7640 .7640 .7640 .7640<br />

.7590 .7590 .7590 .7590<br />

50 points 50 points 50 points 50 points<br />

28 points<br />

55% of range<br />

[.55 x range]<br />

35 points<br />

70% of range<br />

[.7 x range]<br />

55 points<br />

110% of<br />

range<br />

[1.1 x range]<br />

75 points<br />

150% of<br />

range<br />

[1.5 x range]<br />

6. Now we must wait for the DSO for tomorrow’s trade. Once the market<br />

opens, I will take the volatility expansion % ranges and both add and<br />

subtract that value from the opening price. Here is the importance of<br />

coming up with these two prices from the DSO.<br />

First, once the market opens, I will immediately record that price on my worksheet<br />

and compare today’s opening price with yesterday’s high and low prices. I am<br />

specifically looking for a classic Larry Williams “Ooops” buy or sell signal. If I am<br />

long going into the new trading session, and the market opens above the prior day’s<br />

high, then I must be aware of the potential Ooops sell signal. It’s just the opposite<br />

if I am short going into the session. If the market opens below the prior day’s low,<br />

then I must prepare for a possible Oops buy signal. <strong>The</strong> opening price will tell you<br />

immediately if there is a potential gap reversal (“Ooops”) trading signal.<br />

Second, if the trend is up, and the market moves up a certain volatility expansion<br />

percentage above the open, then this tells me that there is continued/renewed<br />

buying interest in this specific contract. If I am long, I am going to “hold what I<br />

got.” I will then recalculate my plan for tomorrow once the market closes, or if the<br />

market later turns around in the session and moves to the volatility expansion %<br />

- 100 -