The 3Dimensional Trading Breakthrough

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

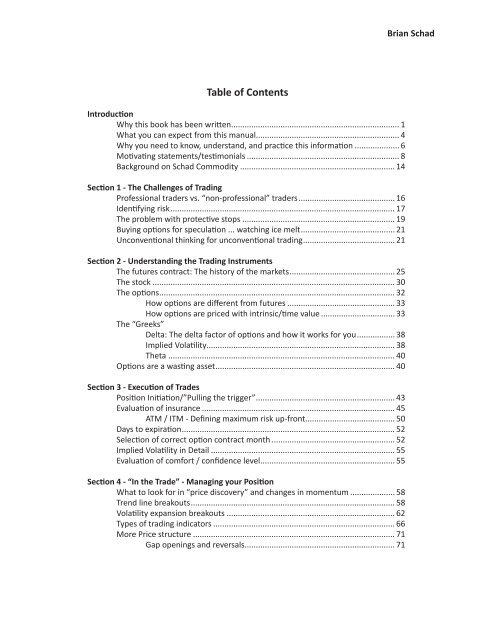

Brian Schad<br />

Table of Contents<br />

Introduction<br />

Why this book has been written........................................................................... 1<br />

What you can expect from this manual................................................................ 4<br />

Why you need to know, understand, and practice this information..................... 6<br />

Motivating statements/testimonials..................................................................... 8<br />

Background on Schad Commodity...................................................................... 14<br />

Section 1 - <strong>The</strong> Challenges of <strong>Trading</strong><br />

Professional traders vs. “non-professional” traders............................................ 16<br />

Identifying risk.................................................................................................... 17<br />

<strong>The</strong> problem with protective stops..................................................................... 19<br />

Buying options for speculation ... watching ice melt.......................................... 21<br />

Unconventional thinking for unconventional trading......................................... 21<br />

Section 2 - Understanding the <strong>Trading</strong> Instruments<br />

<strong>The</strong> futures contract: <strong>The</strong> history of the markets............................................... 25<br />

<strong>The</strong> stock............................................................................................................. 30<br />

<strong>The</strong> options......................................................................................................... 32<br />

How options are different from futures................................................. 33<br />

How options are priced with intrinsic/time value.................................. 33<br />

<strong>The</strong> “Greeks”<br />

Delta: <strong>The</strong> delta factor of options and how it works for you................. 38<br />

Implied Volatility.................................................................................... 38<br />

<strong>The</strong>ta...................................................................................................... 40<br />

Options are a wasting asset................................................................................ 40<br />

Section 3 - Execution of Trades<br />

Position Initiation/”Pulling the trigger”.............................................................. 43<br />

Evaluation of insurance....................................................................................... 45<br />

ATM / ITM - Defining maximum risk up-front........................................ 50<br />

Days to expiration............................................................................................... 52<br />

Selection of correct option contract month........................................................ 52<br />

Implied Volatility in Detail................................................................................... 55<br />

Evaluation of comfort / confidence level............................................................ 55<br />

Section 4 - “In the Trade” - Managing your Position<br />

What to look for in “price discovery” and changes in momentum..................... 58<br />

Trend line breakouts........................................................................................... 58<br />

Volatility expansion breakouts............................................................................ 62<br />

Types of trading indicators.................................................................................. 66<br />

More Price structure........................................................................................... 71<br />

Gap openings and reversals................................................................... 71