The 3Dimensional Trading Breakthrough

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Brian Schad<br />

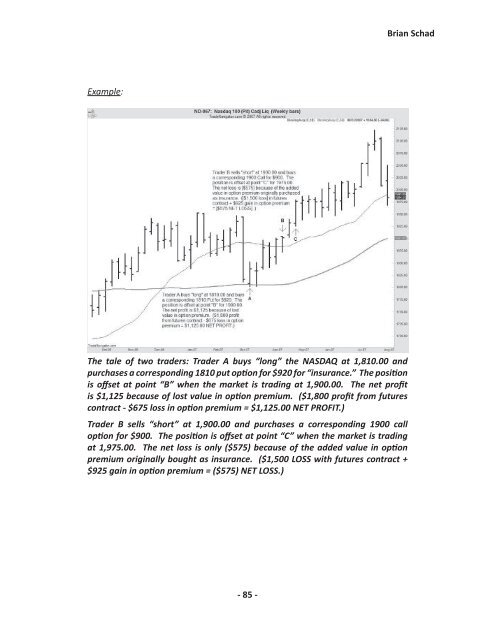

Example:<br />

<strong>The</strong> tale of two traders: Trader A buys “long” the NASDAQ at 1,810.00 and<br />

purchases a corresponding 1810 put option for $920 for “insurance.” <strong>The</strong> position<br />

is offset at point “B” when the market is trading at 1,900.00. <strong>The</strong> net profit<br />

is $1,125 because of lost value in option premium. ($1,800 profit from futures<br />

contract - $675 loss in option premium = $1,125.00 NET PROFIT.)<br />

Trader B sells “short” at 1,900.00 and purchases a corresponding 1900 call<br />

option for $900. <strong>The</strong> position is offset at point “C” when the market is trading<br />

at 1,975.00. <strong>The</strong> net loss is only ($575) because of the added value in option<br />

premium originally bought as insurance. ($1,500 LOSS with futures contract +<br />

$925 gain in option premium = ($575) NET LOSS.)<br />

- 85 -