The 3Dimensional Trading Breakthrough

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Brian Schad<br />

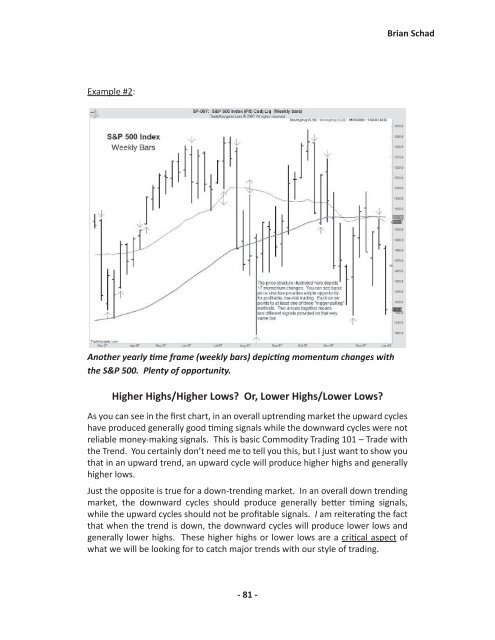

Example #2:<br />

Another yearly time frame (weekly bars) depicting momentum changes with<br />

the S&P 500. Plenty of opportunity.<br />

Higher Highs/Higher Lows? Or, Lower Highs/Lower Lows?<br />

As you can see in the first chart, in an overall uptrending market the upward cycles<br />

have produced generally good timing signals while the downward cycles were not<br />

reliable money-making signals. This is basic Commodity <strong>Trading</strong> 101 – Trade with<br />

the Trend. You certainly don’t need me to tell you this, but I just want to show you<br />

that in an upward trend, an upward cycle will produce higher highs and generally<br />

higher lows.<br />

Just the opposite is true for a down-trending market. In an overall down trending<br />

market, the downward cycles should produce generally better timing signals,<br />

while the upward cycles should not be profitable signals. I am reiterating the fact<br />

that when the trend is down, the downward cycles will produce lower lows and<br />

generally lower highs. <strong>The</strong>se higher highs or lower lows are a critical aspect of<br />

what we will be looking for to catch major trends with our style of trading.<br />

- 81 -