The 3Dimensional Trading Breakthrough

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Brian Schad<br />

Implied volatility fluctuates as a rubber band stretches when pulled by an outside<br />

force and retracts when the outside force is relaxed/removed. <strong>The</strong>se outside<br />

forces (in the case of option premiums) are traders, just like you and me, that are<br />

“bidding up” the price of the call options in an up-trending market, or “bidding<br />

up” the price of the put options in a down-trending market. If the premiums<br />

have been “bid up” very significantly when compared to the recent past, this is<br />

known as high implied volatility - an overvalued status. When unknowing and/or<br />

unsuspecting traders buy options in this condition, the odds are highly against<br />

them for realizing a profit.<br />

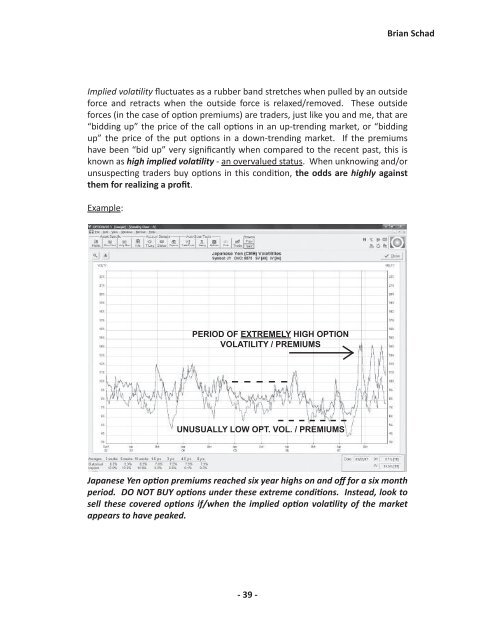

Example:<br />

PERIOD OF EXTREMELY HIGH OPTION<br />

VOLATILITY / PREMIUMS<br />

UNUSUALLY LOW OPT. VOL. / PREMIUMS<br />

Japanese Yen option premiums reached six year highs on and off for a six month<br />

period. DO NOT BUY options under these extreme conditions. Instead, look to<br />

sell these covered options if/when the implied option volatility of the market<br />

appears to have peaked.<br />

- 39 -