Understanding earnings quality - MIT Sloan School of Management

Understanding earnings quality - MIT Sloan School of Management

Understanding earnings quality - MIT Sloan School of Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

They show that firms with larger standard deviations have less persistent <strong>earnings</strong>, longer operating<br />

cycles, larger accruals, and more volatile cash flows, accruals and <strong>earnings</strong>. They are smaller firms<br />

and the firms are more likely to report a loss. They suggest that these firm characteristics are<br />

indicative <strong>of</strong> a greater likelihood <strong>of</strong> estimation error in accruals and thus lower accrual <strong>quality</strong>.<br />

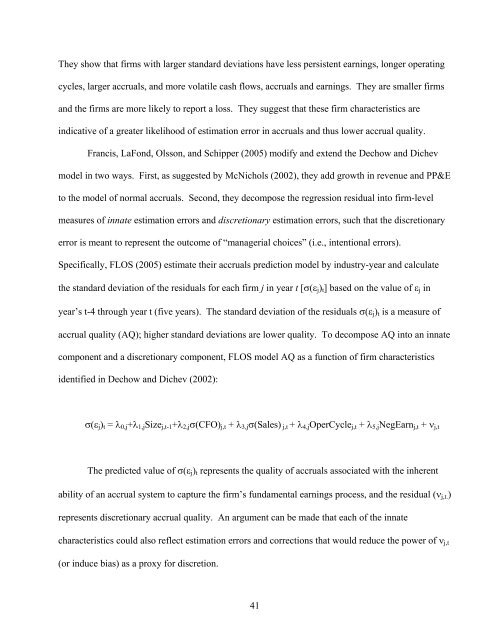

Francis, LaFond, Olsson, and Schipper (2005) modify and extend the Dechow and Dichev<br />

model in two ways. First, as suggested by McNichols (2002), they add growth in revenue and PP&E<br />

to the model <strong>of</strong> normal accruals. Second, they decompose the regression residual into firm-level<br />

measures <strong>of</strong> innate estimation errors and discretionary estimation errors, such that the discretionary<br />

error is meant to represent the outcome <strong>of</strong> “managerial choices” (i.e., intentional errors).<br />

Specifically, FLOS (2005) estimate their accruals prediction model by industry-year and calculate<br />

the standard deviation <strong>of</strong> the residuals for each firm j in year t [σ(εj)t] based on the value <strong>of</strong> εj in<br />

year’s t-4 through year t (five years). The standard deviation <strong>of</strong> the residuals σ(εj)t is a measure <strong>of</strong><br />

accrual <strong>quality</strong> (AQ); higher standard deviations are lower <strong>quality</strong>. To decompose AQ into an innate<br />

component and a discretionary component, FLOS model AQ as a function <strong>of</strong> firm characteristics<br />

identified in Dechow and Dichev (2002):<br />

σ(εj)t = λ0,j+λ1,jSizej,t-1+λ2,jσ(CFO)j,t + λ3,jσ(Sales) j,t + λ4,jOperCyclej,t + λ5,jNegEarnj,t + νj,t<br />

The predicted value <strong>of</strong> σ(εj)t represents the <strong>quality</strong> <strong>of</strong> accruals associated with the inherent<br />

ability <strong>of</strong> an accrual system to capture the firm’s fundamental <strong>earnings</strong> process, and the residual (νj,t.)<br />

represents discretionary accrual <strong>quality</strong>. An argument can be made that each <strong>of</strong> the innate<br />

characteristics could also reflect estimation errors and corrections that would reduce the power <strong>of</strong> νj,t<br />

(or induce bias) as a proxy for discretion.<br />

41