iesy Repository GmbH - Irish Stock Exchange

iesy Repository GmbH - Irish Stock Exchange

iesy Repository GmbH - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

We anticipate that we will be highly leveraged in the foreseeable future. Our high level of debt may have important<br />

negative consequences for you. For more information, see “Risk Factors—Risks Relating to Our Indebtedness and Our<br />

Structure—Our high leverage and debt service obligations could materially adversely affect our business, financial condition<br />

or results of operations.”<br />

In addition, additional indebtedness incurred or the use of available cash on hand to finance acquisitions (including the<br />

ish Acquisition) could reduce the amount of our cash flow available to make payments on the Notes and increase our<br />

leverage. See “The ish Acquisition” and “Risk Factors—Risks Relating to Our Indebtedness and Our Structure.”<br />

Senior Credit Facilities<br />

The Senior Credit Facilities require us to comply with certain covenants, including certain financial ratios. For a<br />

description of the Senior Credit Facilities, see the description included in “Description of Other Indebtedness.”<br />

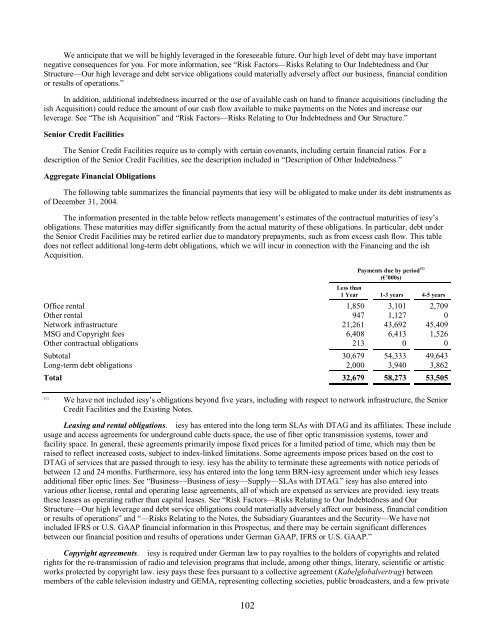

Aggregate Financial Obligations<br />

The following table summarizes the financial payments that <strong>iesy</strong> will be obligated to make under its debt instruments as<br />

of December 31, 2004.<br />

The information presented in the table below reflects management’s estimates of the contractual maturities of <strong>iesy</strong>’s<br />

obligations. These maturities may differ significantly from the actual maturity of these obligations. In particular, debt under<br />

the Senior Credit Facilities may be retired earlier due to mandatory prepayments, such as from excess cash flow. This table<br />

does not reflect additional long-term debt obligations, which we will incur in connection with the Financing and the ish<br />

Acquisition.<br />

102<br />

Payments due by period (1)<br />

(€’000s)<br />

Less than<br />

1 Year 1-3 years 4-5 years<br />

Office rental 1,850 3,101 2,709<br />

Other rental 947 1,127 0<br />

Network infrastructure 21,261 43,692 45,409<br />

MSG and Copyright fees 6,408 6,413 1,526<br />

Other contractual obligations 213 0 0<br />

Subtotal 30,679 54,333 49,643<br />

Long-term debt obligations 2,000 3,940 3,862<br />

Total 32,679 58,273 53,505<br />

(1) We have not included <strong>iesy</strong>’s obligations beyond five years, including with respect to network infrastructure, the Senior<br />

Credit Facilities and the Existing Notes.<br />

Leasing and rental obligations. <strong>iesy</strong> has entered into the long term SLAs with DTAG and its affiliates. These include<br />

usage and access agreements for underground cable ducts space, the use of fiber optic transmission systems, tower and<br />

facility space. In general, these agreements primarily impose fixed prices for a limited period of time, which may then be<br />

raised to reflect increased costs, subject to index-linked limitations. Some agreements impose prices based on the cost to<br />

DTAG of services that are passed through to <strong>iesy</strong>. <strong>iesy</strong> has the ability to terminate these agreements with notice periods of<br />

between 12 and 24 months. Furthermore, <strong>iesy</strong> has entered into the long term BRN-<strong>iesy</strong> agreement under which <strong>iesy</strong> leases<br />

additional fiber optic lines. See “Business—Business of <strong>iesy</strong>—Supply—SLAs with DTAG.” <strong>iesy</strong> has also entered into<br />

various other license, rental and operating lease agreements, all of which are expensed as services are provided. <strong>iesy</strong> treats<br />

these leases as operating rather than capital leases. See “Risk Factors—Risks Relating to Our Indebtedness and Our<br />

Structure—Our high leverage and debt service obligations could materially adversely affect our business, financial condition<br />

or results of operations” and “—Risks Relating to the Notes, the Subsidiary Guarantees and the Security—We have not<br />

included IFRS or U.S. GAAP financial information in this Prospectus, and there may be certain significant differences<br />

between our financial position and results of operations under German GAAP, IFRS or U.S. GAAP.”<br />

Copyright agreements. <strong>iesy</strong> is required under German law to pay royalties to the holders of copyrights and related<br />

rights for the re-transmission of radio and television programs that include, among other things, literary, scientific or artistic<br />

works protected by copyright law. <strong>iesy</strong> pays these fees pursuant to a collective agreement (Kabelglobalvertrag) between<br />

members of the cable television industry and GEMA, representing collecting societies, public broadcasters, and a few private