iesy Repository GmbH - Irish Stock Exchange

iesy Repository GmbH - Irish Stock Exchange

iesy Repository GmbH - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

the security agent for the Senior Credit Facilities; and (b) neither the Holders nor the Trustee may give any instruction to the<br />

Security Trustee to take any enforcement action prohibited by clause (a) above. See “Risk Factors—Risks Relating to the<br />

Notes, the Subsidiary Guarantees and the Security—You may not be able to enforce, or recover any amounts under, the<br />

Subsidiary Guarantees or the Security due to subordination provisions, restrictions on enforcement and releases.”<br />

If the Trustee or any Holder receives proceeds of any enforcement of the Security Interest while the obligations under<br />

the Senior Credit Facilities are outstanding, the Trustee or such Holder, as applicable, will, subject to certain exceptions, turn<br />

over such amounts to the Security Trustee to be applied in the order described under “Description of Other Indebtedness—<br />

Intercreditor Agreement—Turnover.”<br />

Similar provisions may be included in any Additional Intercreditor Agreement entered into in compliance with “—<br />

Certain Covenants—Additional Intercreditor Agreements.”<br />

The Indenture will also provide that each Holder, by accepting a Note, shall be deemed to have agreed to and accepted<br />

the terms and conditions of the Intercreditor Agreement and any Additional Intercreditor Agreement (whether then entered<br />

into or entered into in the future pursuant to the provisions described herein).<br />

Optional Redemption<br />

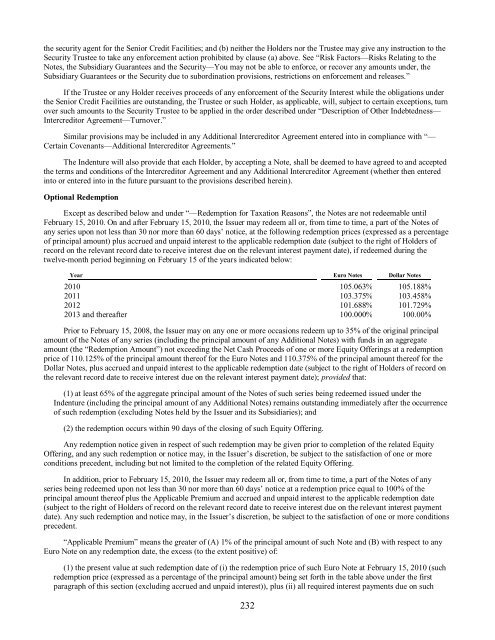

Except as described below and under “—Redemption for Taxation Reasons”, the Notes are not redeemable until<br />

February 15, 2010. On and after February 15, 2010, the Issuer may redeem all or, from time to time, a part of the Notes of<br />

any series upon not less than 30 nor more than 60 days’ notice, at the following redemption prices (expressed as a percentage<br />

of principal amount) plus accrued and unpaid interest to the applicable redemption date (subject to the right of Holders of<br />

record on the relevant record date to receive interest due on the relevant interest payment date), if redeemed during the<br />

twelve-month period beginning on February 15 of the years indicated below:<br />

Year Euro Notes Dollar Notes<br />

2010 105.063% 105.188%<br />

2011 103.375% 103.458%<br />

2012 101.688% 101.729%<br />

2013 and thereafter 100.000% 100.00%<br />

Prior to February 15, 2008, the Issuer may on any one or more occasions redeem up to 35% of the original principal<br />

amount of the Notes of any series (including the principal amount of any Additional Notes) with funds in an aggregate<br />

amount (the “Redemption Amount”) not exceeding the Net Cash Proceeds of one or more Equity Offerings at a redemption<br />

price of 110.125% of the principal amount thereof for the Euro Notes and 110.375% of the principal amount thereof for the<br />

Dollar Notes, plus accrued and unpaid interest to the applicable redemption date (subject to the right of Holders of record on<br />

the relevant record date to receive interest due on the relevant interest payment date); provided that:<br />

(1) at least 65% of the aggregate principal amount of the Notes of such series being redeemed issued under the<br />

Indenture (including the principal amount of any Additional Notes) remains outstanding immediately after the occurrence<br />

of such redemption (excluding Notes held by the Issuer and its Subsidiaries); and<br />

(2) the redemption occurs within 90 days of the closing of such Equity Offering.<br />

Any redemption notice given in respect of such redemption may be given prior to completion of the related Equity<br />

Offering, and any such redemption or notice may, in the Issuer’s discretion, be subject to the satisfaction of one or more<br />

conditions precedent, including but not limited to the completion of the related Equity Offering.<br />

In addition, prior to February 15, 2010, the Issuer may redeem all or, from time to time, a part of the Notes of any<br />

series being redeemed upon not less than 30 nor more than 60 days’ notice at a redemption price equal to 100% of the<br />

principal amount thereof plus the Applicable Premium and accrued and unpaid interest to the applicable redemption date<br />

(subject to the right of Holders of record on the relevant record date to receive interest due on the relevant interest payment<br />

date). Any such redemption and notice may, in the Issuer’s discretion, be subject to the satisfaction of one or more conditions<br />

precedent.<br />

“Applicable Premium” means the greater of (A) 1% of the principal amount of such Note and (B) with respect to any<br />

Euro Note on any redemption date, the excess (to the extent positive) of:<br />

(1) the present value at such redemption date of (i) the redemption price of such Euro Note at February 15, 2010 (such<br />

redemption price (expressed as a percentage of the principal amount) being set forth in the table above under the first<br />

paragraph of this section (excluding accrued and unpaid interest)), plus (ii) all required interest payments due on such<br />

232