iesy Repository GmbH - Irish Stock Exchange

iesy Repository GmbH - Irish Stock Exchange

iesy Repository GmbH - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

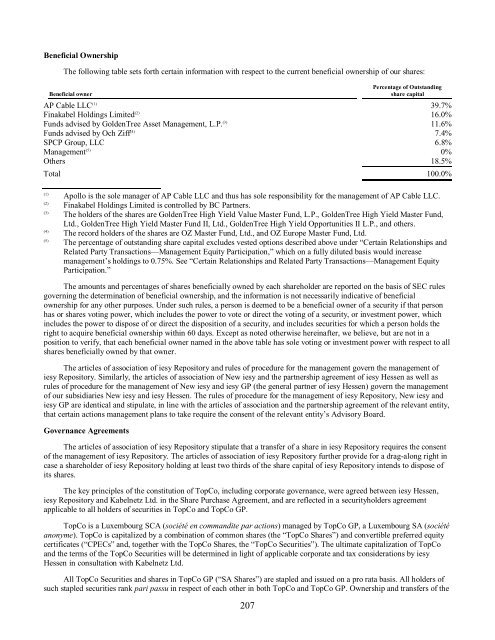

Beneficial Ownership<br />

The following table sets forth certain information with respect to the current beneficial ownership of our shares:<br />

Beneficial owner<br />

207<br />

Percentage of Outstanding<br />

share capital<br />

AP Cable LLC (1) 39.7%<br />

Finakabel Holdings Limited (2) 16.0%<br />

Funds advised by GoldenTree Asset Management, L.P. (3) 11.6%<br />

Funds advised by Och Ziff (4) 7.4%<br />

SPCP Group, LLC 6.8%<br />

Management (5) 0%<br />

Others 18.5%<br />

Total 100.0%<br />

(1) Apollo is the sole manager of AP Cable LLC and thus has sole responsibility for the management of AP Cable LLC.<br />

(2) Finakabel Holdings Limited is controlled by BC Partners.<br />

(3) The holders of the shares are GoldenTree High Yield Value Master Fund, L.P., GoldenTree High Yield Master Fund,<br />

Ltd., GoldenTree High Yield Master Fund II, Ltd., GoldenTree High Yield Opportunities II L.P., and others.<br />

(4) The record holders of the shares are OZ Master Fund, Ltd., and OZ Europe Master Fund, Ltd.<br />

(5) The percentage of outstanding share capital excludes vested options described above under “Certain Relationships and<br />

Related Party Transactions—Management Equity Participation,” which on a fully diluted basis would increase<br />

management’s holdings to 0.75%. See “Certain Relationships and Related Party Transactions—Management Equity<br />

Participation.”<br />

The amounts and percentages of shares beneficially owned by each shareholder are reported on the basis of SEC rules<br />

governing the determination of beneficial ownership, and the information is not necessarily indicative of beneficial<br />

ownership for any other purposes. Under such rules, a person is deemed to be a beneficial owner of a security if that person<br />

has or shares voting power, which includes the power to vote or direct the voting of a security, or investment power, which<br />

includes the power to dispose of or direct the disposition of a security, and includes securities for which a person holds the<br />

right to acquire beneficial ownership within 60 days. Except as noted otherwise hereinafter, we believe, but are not in a<br />

position to verify, that each beneficial owner named in the above table has sole voting or investment power with respect to all<br />

shares beneficially owned by that owner.<br />

The articles of association of <strong>iesy</strong> <strong>Repository</strong> and rules of procedure for the management govern the management of<br />

<strong>iesy</strong> <strong>Repository</strong>. Similarly, the articles of association of New <strong>iesy</strong> and the partnership agreement of <strong>iesy</strong> Hessen as well as<br />

rules of procedure for the management of New <strong>iesy</strong> and <strong>iesy</strong> GP (the general partner of <strong>iesy</strong> Hessen) govern the management<br />

of our subsidiaries New <strong>iesy</strong> and <strong>iesy</strong> Hessen. The rules of procedure for the management of <strong>iesy</strong> <strong>Repository</strong>, New <strong>iesy</strong> and<br />

<strong>iesy</strong> GP are identical and stipulate, in line with the articles of association and the partnership agreement of the relevant entity,<br />

that certain actions management plans to take require the consent of the relevant entity’s Advisory Board.<br />

Governance Agreements<br />

The articles of association of <strong>iesy</strong> <strong>Repository</strong> stipulate that a transfer of a share in <strong>iesy</strong> <strong>Repository</strong> requires the consent<br />

of the management of <strong>iesy</strong> <strong>Repository</strong>. The articles of association of <strong>iesy</strong> <strong>Repository</strong> further provide for a drag-along right in<br />

case a shareholder of <strong>iesy</strong> <strong>Repository</strong> holding at least two thirds of the share capital of <strong>iesy</strong> <strong>Repository</strong> intends to dispose of<br />

its shares.<br />

The key principles of the constitution of TopCo, including corporate governance, were agreed between <strong>iesy</strong> Hessen,<br />

<strong>iesy</strong> <strong>Repository</strong> and Kabelnetz Ltd. in the Share Purchase Agreement, and are reflected in a securityholders agreement<br />

applicable to all holders of securities in TopCo and TopCo GP.<br />

TopCo is a Luxembourg SCA (société en commandite par actions) managed by TopCo GP, a Luxembourg SA (société<br />

anonyme). TopCo is capitalized by a combination of common shares (the “TopCo Shares”) and convertible preferred equity<br />

certificates (“CPECs” and, together with the TopCo Shares, the “TopCo Securities”). The ultimate capitalization of TopCo<br />

and the terms of the TopCo Securities will be determined in light of applicable corporate and tax considerations by <strong>iesy</strong><br />

Hessen in consultation with Kabelnetz Ltd.<br />

All TopCo Securities and shares in TopCo GP (“SA Shares”) are stapled and issued on a pro rata basis. All holders of<br />

such stapled securities rank pari passu in respect of each other in both TopCo and TopCo GP. Ownership and transfers of the