iesy Repository GmbH - Irish Stock Exchange

iesy Repository GmbH - Irish Stock Exchange

iesy Repository GmbH - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ights themselves. As an exception, however, broadcasters have the choice to assert their rights individually or via a<br />

collecting society.<br />

GEMA, one of the German collecting societies, has been mandated by most of the relevant German collecting societies<br />

to collect royalties from the telecommunications cable network operators. The large German private broadcasters, however,<br />

mandated VG Media to assert their royalty claims based on their cable re-transmission rights. The amount of the royalties due<br />

is not determined in the Copyright Act.<br />

On November 21, 1991, the legal predecessor of DTAG concluded agreements with the German public broadcasters,<br />

the German private broadcasters, certain foreign broadcasters and GEMA (acting both on its own behalf and on behalf of<br />

other relevant German collecting societies). These agreements governed the collection by GEMA of royalties for, among<br />

other things, literary, scientific or artistic works protected by copyright law that were included in radio and television<br />

programs re-transmitted through the telecommunications cable networks that are today operated by the regional cable<br />

companies. In 2000, a dispute over the amount of royalties to be paid to GEMA and to the German private broadcasters<br />

arose, and the existing agreements were terminated with effect from December 31, 2002. The parties involved entered into<br />

lengthy negotiations leading to the following settlements:<br />

The Level 3 operators, the German public broadcasters, a number of small private German radio and television<br />

companies, certain foreign broadcasters and GEMA (acting both on its own behalf and on behalf of these private and foreign<br />

broadcasters and the other relevant German collecting societies except for VG Media) agreed to amend and reinstate the<br />

agreements that had previously been terminated with effect of January 1, 2003. The new agreements cover analog and digital<br />

transmission and will remain in force until December 31, 2006.<br />

ish, the other Level 3 operators and VG Media entered into an agreement regarding the acquisition of rights for the<br />

retransmission of radio and television programs that include, among other things, literary, scientific or artistic work protected<br />

by copyright law, through the telecommunications cable networks of the regional cable companies. This agreement came into<br />

force on January 1, 2003 and may be terminated by each party on December 31, 2005, at the earliest.<br />

In the three months ended March 31, 2005, total copyright fees paid by ish under the GEMA and the VG Media<br />

agreements amounted to €4.7 million, and in the year ended December 31, 2004 amounted to €18.7 million.<br />

Some other collecting societies represented by ARGE Kabel have claimed additional royalty payments from ish.<br />

ARGE Kabel, an association of three German collecting societies, did not fully accept the GEMA settlements and claims that<br />

it is entitled to additional royalty payments from ish. Although ARGE Kabel has not filed a lawsuit against ish, it has<br />

threatened to sue ish through a letter dated December 11, 2003 to recover these royalties. ish intends to vigorously defend<br />

itself against this claim. Meanwhile, ARGE Kabel has sued KDG. The case is pending at the arbitration court in Munich.<br />

The German legislature is currently considering a reform of the German Copyright Act. As part of the reform, the<br />

obligation of operators of telecommunications cable networks to pay royalties for the transmission of radio and television<br />

programs is under scrutiny. Despite the submission of legal studies and the support of the Federal Ministry of Economics and<br />

Labor, the Ministry of Justice has not yet changed the relevant provision of the Copyright Act to the benefit of cable<br />

operators by providing a respective amendment of the Copyright Act in the official draft. The reform process is ongoing. A<br />

proposal for separate royalties for broadcasters, however, has so far not been integrated into the current official draft<br />

amending the Copyright Act.<br />

Properties<br />

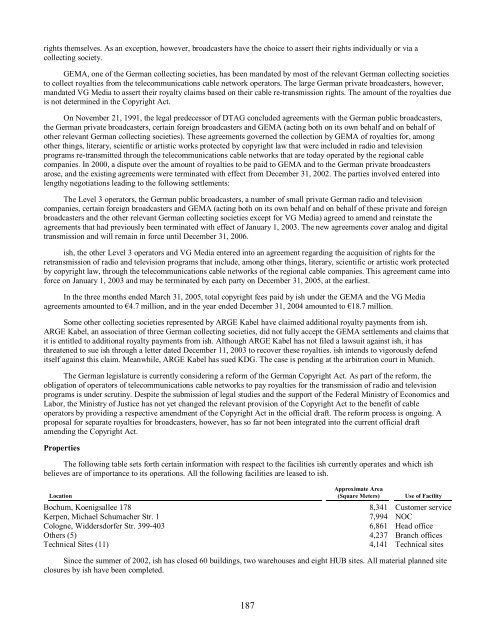

The following table sets forth certain information with respect to the facilities ish currently operates and which ish<br />

believes are of importance to its operations. All the following facilities are leased to ish.<br />

Location<br />

187<br />

Approximate Area<br />

(Square Meters) Use of Facility<br />

Bochum, Koenigsallee 178 8,341 Customer service<br />

Kerpen, Michael Schumacher Str. 1 7,994 NOC<br />

Cologne, Widdersdorfer Str. 399-403 6,861 Head office<br />

Others (5) 4,237 Branch offices<br />

Technical Sites (11) 4,141 Technical sites<br />

Since the summer of 2002, ish has closed 60 buildings, two warehouses and eight HUB sites. All material planned site<br />

closures by ish have been completed.