iesy Repository GmbH - Irish Stock Exchange

iesy Repository GmbH - Irish Stock Exchange

iesy Repository GmbH - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The German Internet Access Market<br />

Germany is the largest Internet market in Europe with approximately 35 million Internet users and approximately 23<br />

million Internet subscribers (defined as persons subscribing to Internet service provider contracts). According to industry<br />

sources for the year 2003, the German internet access market was worth approximately €5.2 billion. Internet access<br />

technology currently available in Germany includes analog dial-up modems, ISDN, DSL, wireless local loop technology,<br />

broadband cable, fiber optic based access and UMTS (Universal Mobile Telecommunication Services). While analog dial-up<br />

modems may be used throughout Germany to connect to the Internet, access via the other technologies depends upon the<br />

local availability of the services.<br />

The Internet access market offers significant growth potential in Germany, particularly in high speed Internet with just<br />

18% of the 39.1 million households having subscribed to such services. High speed Internet services have shown growth<br />

rates of approximately 40% in 2003 and approximately 53% in 2004. At the end of 2004, about 6.9 million (approximately<br />

30%) of the estimated 23 million Internet access subscribers were subscribing to broadband Internet access technologies that<br />

offer connection speeds of more than 128 kbit/s. At the end of 2004, approximately 6.7 million or 97.2% of the 6.9 million<br />

broadband Internet subscribers, either directly or indirectly, used DSL Internet services provided by DTAG, the dominant<br />

player in the German broadband Internet access market, which offers a range of different DSL packages based on bandwidth<br />

and price. Only 145,000 Internet users were subscribing to broadband Internet services via cable and approximately 50,000<br />

Internet users were subscribers to broadband Internet services via satellite or Powerline.<br />

While broadband Internet continues to grow, cable as an access technology has a limited share of the overall broadband<br />

Internet access market, estimated at 2% for 2004. This low level of penetration has been the result of low levels of investment<br />

in the infrastructure and the separation of network levels in Germany. However, all of the Level 3 operators have recently<br />

intensified their network upgrade plans and marketing efforts to promote their Internet service offerings. An advantage of<br />

cable as an access technology is the simplicity of the technology deployed to connect to the Internet. While DSL solutions<br />

require the installation of a series of technical devices (splitter, a/b converter, DSL modem), Internet access via cable merely<br />

requires the installation of a cable modem between the consumer’s television wall socket and the computer. In addition, there<br />

is no need for a subscriber to cable Internet access services to subscribe to telephony services in order to access the service, as<br />

is the case with the majority of DSL offers.<br />

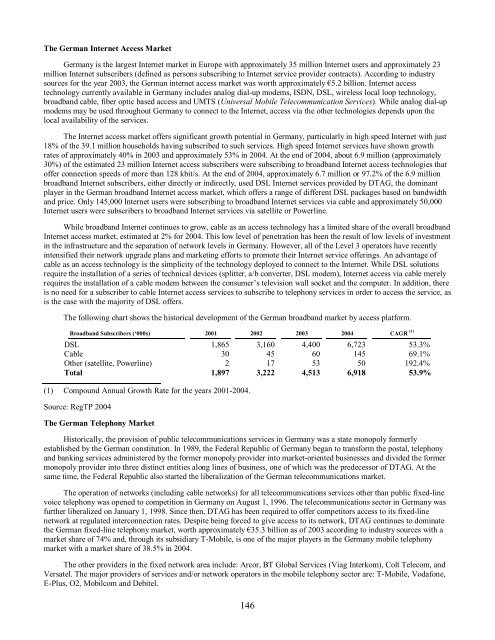

The following chart shows the historical development of the German broadband market by access platform.<br />

Broadband Subscribers (‘000s) 2001 2002 2003 2004 CAGR (1)<br />

DSL 1,865 3,160 4,400 6,723 53.3%<br />

Cable 30 45 60 145 69.1%<br />

Other (satellite, Powerline) 2 17 53 50 192.4%<br />

Total 1,897 3,222 4,513 6,918 53.9%<br />

(1) Compound Annual Growth Rate for the years 2001-2004.<br />

Source: RegTP 2004<br />

The German Telephony Market<br />

Historically, the provision of public telecommunications services in Germany was a state monopoly formerly<br />

established by the German constitution. In 1989, the Federal Republic of Germany began to transform the postal, telephony<br />

and banking services administered by the former monopoly provider into market-oriented businesses and divided the former<br />

monopoly provider into three distinct entities along lines of business, one of which was the predecessor of DTAG. At the<br />

same time, the Federal Republic also started the liberalization of the German telecommunications market.<br />

The operation of networks (including cable networks) for all telecommunications services other than public fixed-line<br />

voice telephony was opened to competition in Germany on August 1, 1996. The telecommunications sector in Germany was<br />

further liberalized on January 1, 1998. Since then, DTAG has been required to offer competitors access to its fixed-line<br />

network at regulated interconnection rates. Despite being forced to give access to its network, DTAG continues to dominate<br />

the German fixed-line telephony market, worth approximately €35.3 billion as of 2003 according to industry sources with a<br />

market share of 74% and, through its subsidiary T-Mobile, is one of the major players in the Germany mobile telephony<br />

market with a market share of 38.5% in 2004.<br />

The other providers in the fixed network area include: Arcor, BT Global Services (Viag Interkom), Colt Telecom, and<br />

Versatel. The major providers of services and/or network operators in the mobile telephony sector are: T-Mobile, Vodafone,<br />

E-Plus, O2, Mobilcom and Debitel.<br />

146