Frequently Asked Questions - LexisNexis

Frequently Asked Questions - LexisNexis

Frequently Asked Questions - LexisNexis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Set up an interest rate table:<br />

1. On the Options pull-down menu, click System Settings.<br />

2. Click the Past Due Notices tab.<br />

3. Click Use Rate Table.<br />

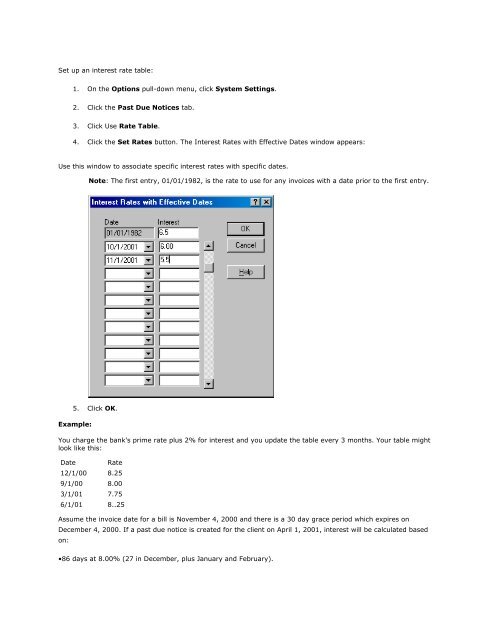

4. Click the Set Rates button. The Interest Rates with Effective Dates window appears:<br />

Use this window to associate specific interest rates with specific dates.<br />

Note: The first entry, 01/01/1982, is the rate to use for any invoices with a date prior to the first entry.<br />

5. Click OK.<br />

Example:<br />

You charge the bank's prime rate plus 2% for interest and you update the table every 3 months. Your table might<br />

look like this:<br />

Date Rate<br />

12/1/00 8.25<br />

9/1/00 8.00<br />

3/1/01 7.75<br />

6/1/01 8..25<br />

Assume the invoice date for a bill is November 4, 2000 and there is a 30 day grace period which expires on<br />

December 4, 2000. If a past due notice is created for the client on April 1, 2001, interest will be calculated based<br />

on:<br />

•86 days at 8.00% (27 in December, plus January and February).