Frequently Asked Questions - LexisNexis

Frequently Asked Questions - LexisNexis

Frequently Asked Questions - LexisNexis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

General Ledger Accounts<br />

Debit Enter the G/L account to debit with the company contribution. This is typically an expense account.<br />

Credit Enter the G/L account to credit with both the employee deduction and the company contribution. This is<br />

typically a withholding (liability) account.<br />

For the cash method of accounting: If you do not want to account for the withholding until it is actually<br />

remitted, use the same expense account in both the Debit and Credit boxes. When the remittance is paid, allocate<br />

the check to the expense account. After the remittance is paid, the net balance in this account is the expense<br />

portion contributed by the company. (Use a payroll history report for the period in question to determine the<br />

amount to remit.)<br />

Plan Type<br />

The plan type determines whether taxes will be charged on the contributions.<br />

401(K) Plan<br />

Social Security, Medicare, Federal and State Unemployment, State Disability and Workers Compensation<br />

calculations are based on the Gross Wages.<br />

Federal, State and Local Income Tax calculations are based on the Gross Wages minus the Employee Contribution.<br />

Cafeteria Plan<br />

All tax calculations are based on the Gross Wages minus the Employee Contribution.<br />

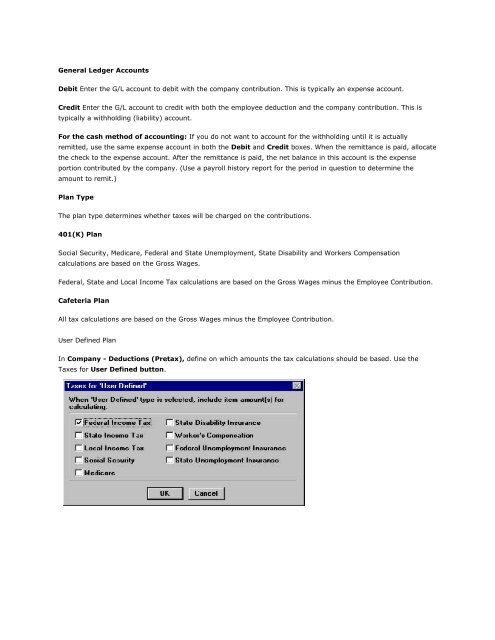

User Defined Plan<br />

In Company - Deductions (Pretax), define on which amounts the tax calculations should be based. Use the<br />

Taxes for User Defined button.