Frequently Asked Questions - LexisNexis

Frequently Asked Questions - LexisNexis

Frequently Asked Questions - LexisNexis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

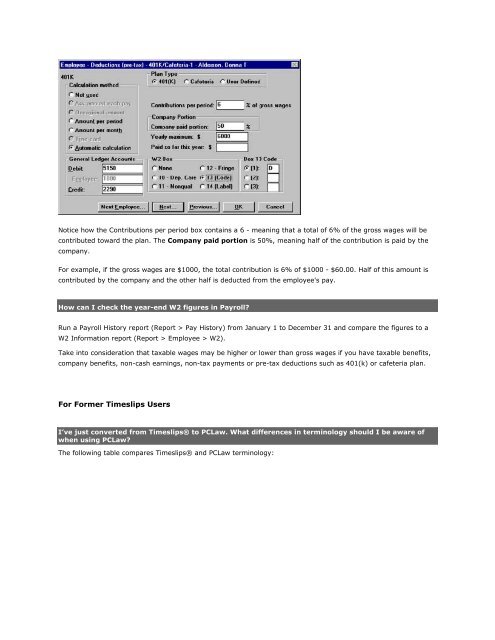

Notice how the Contributions per period box contains a 6 - meaning that a total of 6% of the gross wages will be<br />

contributed toward the plan. The Company paid portion is 50%, meaning half of the contribution is paid by the<br />

company.<br />

For example, if the gross wages are $1000, the total contribution is 6% of $1000 - $60.00. Half of this amount is<br />

contributed by the company and the other half is deducted from the employee's pay.<br />

How can I check the year-end W2 figures in Payroll?<br />

Run a Payroll History report (Report > Pay History) from January 1 to December 31 and compare the figures to a<br />

W2 Information report (Report > Employee > W2).<br />

Take into consideration that taxable wages may be higher or lower than gross wages if you have taxable benefits,<br />

company benefits, non-cash earnings, non-tax payments or pre-tax deductions such as 401(k) or cafeteria plan.<br />

For Former Timeslips Users<br />

I’ve just converted from Timeslips® to PCLaw. What differences in terminology should I be aware of<br />

when using PCLaw?<br />

The following table compares Timeslips® and PCLaw terminology: