Frequently Asked Questions - LexisNexis

Frequently Asked Questions - LexisNexis

Frequently Asked Questions - LexisNexis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3/1/01 7.75<br />

6/1/01 8..25<br />

Assume the invoice date for a bill is November 4, 2000 and there is a 30 day grace period which expires on<br />

December 4, 2000. If a past due notice is created for the client on April 1, 2001, interest will be calculated based<br />

on:<br />

•86 days at 8.00% (27 in December, plus January and February).<br />

•32 days at 7.75% (March, plus April 1).<br />

For PCLawPro or the Past Due Notices optional module.<br />

How can I compound the interest on invoices twice per year?<br />

Select a compounding frequency:<br />

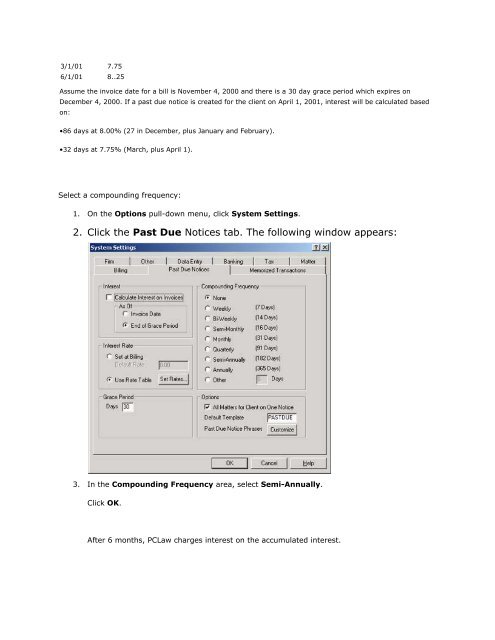

1. On the Options pull-down menu, click System Settings.<br />

2. Click the Past Due Notices tab. The following window appears:<br />

3. In the Compounding Frequency area, select Semi-Annually.<br />

Click OK.<br />

After 6 months, PCLaw charges interest on the accumulated interest.<br />

For PCLawPro or the Past Due Notices optional module.<br />

The grace period for interest on invoices is 30 days but for a few matters I would like to extend their