IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

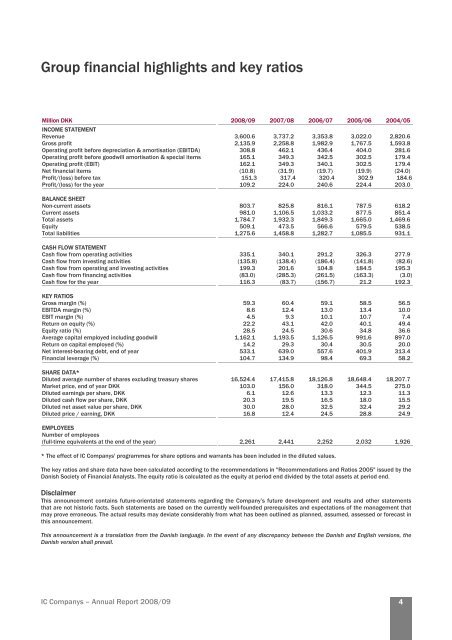

Group financial highlights and key ratios<br />

Million DKK <strong>2008</strong>/<strong>09</strong> 2007/08 2006/07 2005/06 2004/05<br />

INCOME STATEMENT<br />

Revenue 3,600.6 3,737.2 3,353.8 3,022.0 2,820.6<br />

Gross profit 2,135.9 2,258.8 1,982.9 1,767.5 1,593.8<br />

Operating profit before depreciation & amortisation (EBITDA) 308.8 462.1 436.4 404.0 281.6<br />

Operating profit before goodwill amortisation & special items 165.1 349.3 342.5 302.5 179.4<br />

Operating profit (EBIT) 162.1 349.3 340.1 302.5 179.4<br />

Net financial items (10.8) (31.9) (19.7) (19.9) (24.0)<br />

Profit/(loss) before tax 151.3 317.4 320.4 302.9 184.6<br />

Profit/(loss) for the year 1<strong>09</strong>.2 224.0 240.6 224.4 203.0<br />

BALANCE SHEET<br />

Non-current assets 803.7 825.8 816.1 787.5 618.2<br />

Current assets 981.0 1,106.5 1,033.2 877.5 851.4<br />

Total assets 1,784.7 1,932.3 1,849.3 1,665.0 1,469.6<br />

Equity 5<strong>09</strong>.1 473.5 566.6 579.5 538.5<br />

Total liabilities 1,275.6 1,458.8 1,282.7 1,085.5 931.1<br />

CASH FLOW STATEMENT<br />

Cash flow from operating activities 335.1 340.1 291.2 326.3 277.9<br />

Cash flow from investing activities (135.8) (138.4) (186.4) (141.8) (82.6)<br />

Cash flow from operating and investing activities 199.3 201.6 104.8 184.5 195.3<br />

Cash flow from financing activities (83.0) (285.3) (261.5) (163.3) (3.0)<br />

Cash flow for the year 116.3 (83.7) (156.7) 21.2 192.3<br />

KEY RATIOS<br />

Gross margin (%) 59.3 60.4 59.1 58.5 56.5<br />

EBITDA margin (%) 8.6 12.4 13.0 13.4 10.0<br />

EBIT margin (%) 4.5 9.3 10.1 10.7 7.4<br />

Return on equity (%) 22.2 43.1 42.0 40.1 49.4<br />

Equity ratio (%) 28.5 24.5 30.6 34.8 36.6<br />

Average capital employed including goodwill 1,162.1 1,193.5 1,126.5 991.6 897.0<br />

Return on capital employed (%) 14.2 29.3 30.4 30.5 20.0<br />

Net interest-bearing debt, end of year 533.1 639.0 557.6 401.9 313.4<br />

Financial leverage (%) 104.7 134.9 98.4 69.3 58.2<br />

SHARE DATA*<br />

Diluted average number of shares excluding treasury shares 16,524.4 17,415.8 18,126.8 18,648.4 18,207.7<br />

Market price, end of year DKK 103.0 156.0 318.0 344.5 275.0<br />

Diluted earnings per share, DKK 6.1 12.6 13.3 12.3 11.3<br />

Diluted cash flow per share, DKK 20.3 19.5 16.5 18.0 15.5<br />

Diluted net asset value per share, DKK 30.0 28.0 32.5 32.4 29.2<br />

Diluted price / earning, DKK 16.8 12.4 24.5 28.8 24.9<br />

EMPLOYEES<br />

Number of employees<br />

(full-time equivalents at the end of the year)<br />

2,261<br />

2,441<br />

2,252<br />

* The effect of <strong>IC</strong> <strong>Companys</strong>' programmes for share options and warrants has been included in the diluted values.<br />

The key ratios and share data have been calculated according to the recommendations in "Recommendations and Ratios 2005" issued by the<br />

Danish Society of Financial Analysts. The equity ratio is calculated as the equity at period end divided by the total assets at period end.<br />

Disclaimer<br />

This announcement contains future-orientated statements regarding the Company’s future development and results and other statements<br />

that are not historic facts. Such statements are based on the currently well-founded prerequisites and expectations of the management that<br />

may prove erroneous. The actual results may deviate considerably from what has been outlined as planned, assumed, assessed or forecast in<br />

this announcement.<br />

This announcement is a translation from the Danish language. In the event of any discrepancy between the Danish and English versions, the<br />

Danish version shall prevail.<br />

<strong>IC</strong> <strong>Companys</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>/<strong>09</strong><br />

2,032<br />

1,926<br />

4