IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

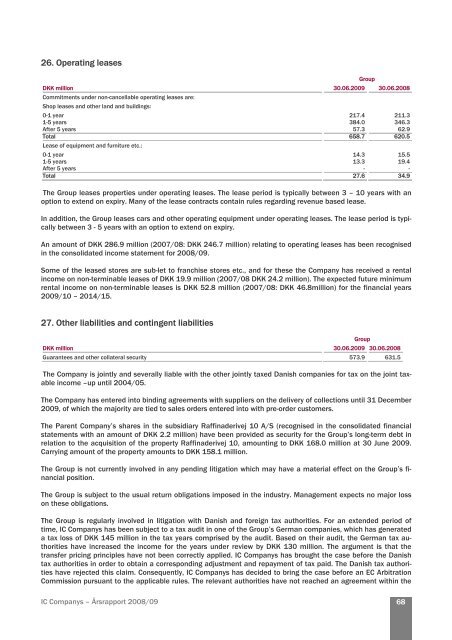

26. Operating leases<br />

DKK million 30.06.20<strong>09</strong> 30.06.<strong>2008</strong><br />

Commitments under non-cancellable operating leases are:<br />

Shop leases and other land and buildings:<br />

0-1 year 217.4 211.3<br />

1-5 years 384.0 346.3<br />

After 5 years 57.3 62.9<br />

Total 658.7 620.5<br />

Lease of equipment and furniture etc.:<br />

0-1 year 14.3 15.5<br />

1-5 years 13.3 19.4<br />

After 5 years - -<br />

Total 27.6 34.9<br />

The Group leases properties under operating leases. The lease period is typically between 3 – 10 years with an<br />

option to extend on expiry. Many of the lease contracts contain rules regarding revenue based lease.<br />

In addition, the Group leases cars and other operating equipment under operating leases. The lease period is typically<br />

between 3 - 5 years with an option to extend on expiry.<br />

An amount of DKK 286.9 million (2007/08: DKK 246.7 million) relating to operating leases has been recognised<br />

in the consolidated income statement for <strong>2008</strong>/<strong>09</strong>.<br />

Some of the leased stores are sub-let to franchise stores etc., and for these the Company has received a rental<br />

income on non-terminable leases of DKK 19.9 million (2007/08 DKK 24.2 million). The expected future minimum<br />

rental income on non-terminable leases is DKK 52.8 million (2007/08: DKK 46.8million) for the financial years<br />

20<strong>09</strong>/10 – 2014/15.<br />

27. Other liabilities and contingent liabilities<br />

DKK million 30.06.20<strong>09</strong> 30.06.<strong>2008</strong><br />

Guarantees and other collateral security 573.9 631.5<br />

The Company is jointly and severally liable with the other jointly taxed Danish companies for tax on the joint taxable<br />

income –up until 2004/05.<br />

The Company has entered into binding agreements with suppliers on the delivery of collections until 31 December<br />

20<strong>09</strong>, of which the majority are tied to sales orders entered into with pre-order customers.<br />

The Parent Company’s shares in the subsidiary Raffinaderivej 10 A/S (recognised in the consolidated financial<br />

statements with an amount of DKK 2.2 million) have been provided as security for the Group’s long-term debt in<br />

relation to the acquisition of the property Raffinaderivej 10, amounting to DKK 168.0 million at 30 June 20<strong>09</strong>.<br />

Carrying amount of the property amounts to DKK 158.1 million.<br />

The Group is not currently involved in any pending litigation which may have a material effect on the Group’s financial<br />

position.<br />

The Group is subject to the usual return obligations imposed in the industry. Management expects no major loss<br />

on these obligations.<br />

The Group is regularly involved in litigation with Danish and foreign tax authorities. For an extended period of<br />

time, <strong>IC</strong> <strong>Companys</strong> has been subject to a tax audit in one of the Group’s German companies, which has generated<br />

a tax loss of DKK 145 million in the tax years comprised by the audit. Based on their audit, the German tax authorities<br />

have increased the income for the years under review by DKK 130 million. The argument is that the<br />

transfer pricing principles have not been correctly applied. <strong>IC</strong> <strong>Companys</strong> has brought the case before the Danish<br />

tax authorities in order to obtain a corresponding adjustment and repayment of tax paid. The Danish tax authorities<br />

have rejected this claim. Consequently, <strong>IC</strong> <strong>Companys</strong> has decided to bring the case before an EC Arbitration<br />

Commission pursuant to the applicable rules. The relevant authorities have not reached an agreement within the<br />

<strong>IC</strong> <strong>Companys</strong> – Årsrapport <strong>2008</strong>/<strong>09</strong><br />

Group<br />

Group<br />

68