IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

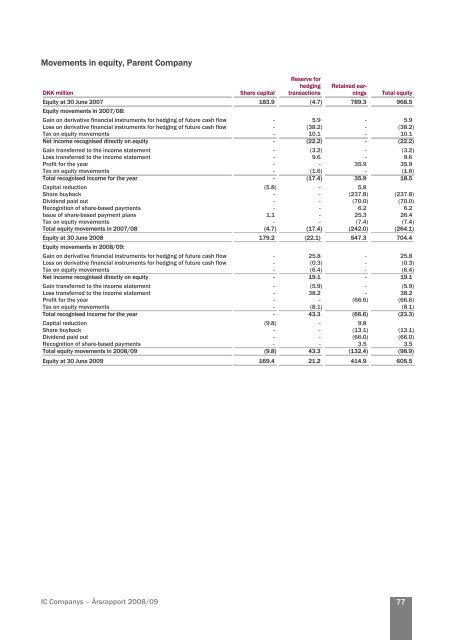

Movements in equity, Parent Company<br />

DKK million Share capital<br />

Reserve for<br />

hedging<br />

transactions<br />

Retained earnings<br />

Total equity<br />

Equity at 30 June 2007 183.9 (4.7) 789.3 968.5<br />

Equity movements in 2007/08:<br />

Gain on derivative financial instruments for hedging of future cash flow - 5.9 - 5.9<br />

Loss on derivative financial instruments for hedging of future cash flow - (38.2) - (38.2)<br />

Tax on equity movements - 10.1 - 10.1<br />

Net income recognised directly on equity - (22.2) - (22.2)<br />

Gain transferred to the income statement - (3.2) - (3.2)<br />

Loss transferred to the income statement - 9.6 - 9.6<br />

Profit for the year - - 35.9 35.9<br />

Tax on equity movements - (1.6) - (1.6)<br />

Total recognised income for the year - (17.4) 35.9 18.5<br />

Capital reduction (5.8) - 5.8<br />

Share buyback - - (237.8) (237.8)<br />

Dividend paid out - - (70.0) (70.0)<br />

Recognition of share-based payments - - 6.2 6.2<br />

Issue of share-based payment plans 1.1 - 25.3 26.4<br />

Tax on equity movements - - (7.4) (7.4)<br />

Total equity movements in 2007/08 (4.7) (17.4) (242.0) (264.1)<br />

Equity at 30 June <strong>2008</strong> 179.2 (22.1) 547.3 704.4<br />

Equity movements in <strong>2008</strong>/<strong>09</strong>:<br />

Gain on derivative financial instruments for hedging of future cash flow - 25.8 - 25.8<br />

Loss on derivative financial instruments for hedging of future cash flow - (0.3) - (0.3)<br />

Tax on equity movements - (6.4) - (6.4)<br />

Net income recognised directly on equity - 19.1 - 19.1<br />

Gain transferred to the income statement - (5.9) - (5.9)<br />

Loss transferred to the income statement - 38.2 - 38.2<br />

Profit for the year - - (66.6) (66.6)<br />

Tax on equity movements - (8.1) (8.1)<br />

Total recognised income for the year - 43.3 (66.6) (23.3)<br />

Capital reduction (9.8) - 9.8<br />

Share buyback - - (13.1) (13.1)<br />

Dividend paid out - - (66.0) (66.0)<br />

Recognition of share-based payments - - 3.5 3.5<br />

Total equity movements in <strong>2008</strong>/<strong>09</strong> (9.8) 43.3 (132.4) (98.9)<br />

Equity at 30 June 20<strong>09</strong> 169.4 21.2 414.9 605.5<br />

<strong>IC</strong> <strong>Companys</strong> – Årsrapport <strong>2008</strong>/<strong>09</strong><br />

77