IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

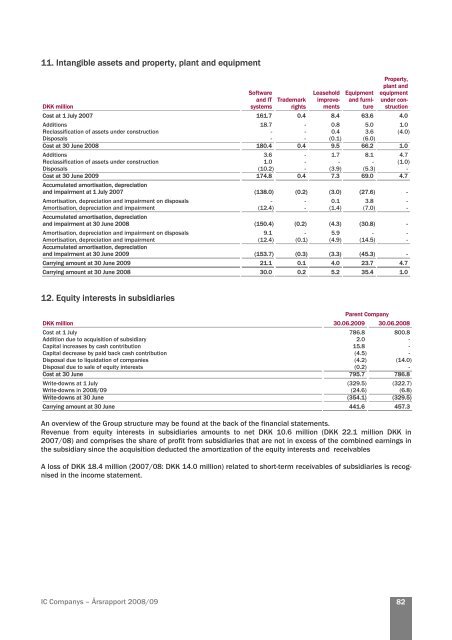

11. Intangible assets and property, plant and equipment<br />

DKK million<br />

Software<br />

and IT<br />

systems<br />

Trademark<br />

rights<br />

Leasehold<br />

improvements<br />

Equipment<br />

and furniture<br />

Property,<br />

plant and<br />

equipment<br />

under construction<br />

Cost at 1 July 2007 161.7 0.4 8.4 63.6 4.0<br />

Additions 18.7 - 0.8 5.0 1.0<br />

Reclassification of assets under construction - - 0.4 3.6 (4.0)<br />

Disposals - - (0.1) (6.0)<br />

Cost at 30 June <strong>2008</strong> 180.4 0.4 9.5 66.2 1.0<br />

Additions 3.6 - 1.7 8.1 4.7<br />

Reclassification of assets under construction 1.0 - - - (1.0)<br />

Disposals (10.2) - (3.9) (5.3) -<br />

Cost at 30 June 20<strong>09</strong> 174.8 0.4 7.3 69.0 4.7<br />

Accumulated amortisation, depreciation<br />

and impairment at 1 July 2007 (138.0) (0.2) (3.0) (27.6) -<br />

Amortisation, depreciation and impairment on disposals - - 0.1 3.8 -<br />

Amortisation, depreciation and impairment (12.4) - (1.4) (7.0) -<br />

Accumulated amortisation, depreciation<br />

and impairment at 30 June <strong>2008</strong> (150.4) (0.2) (4.3) (30.8) -<br />

Amortisation, depreciation and impairment on disposals 9.1 - 5.9 - -<br />

Amortisation, depreciation and impairment (12.4) (0.1) (4.9) (14.5) -<br />

Accumulated amortisation, depreciation<br />

and impairment at 30 June 20<strong>09</strong> (153.7) (0.3) (3.3) (45.3) -<br />

Carrying amount at 30 June 20<strong>09</strong> 21.1 0.1 4.0 23.7 4.7<br />

Carrying amount at 30 June <strong>2008</strong> 30.0 0.2 5.2 35.4 1.0<br />

12. Equity interests in subsidiaries<br />

Parent Company<br />

DKK million 30.06.20<strong>09</strong> 30.06.<strong>2008</strong><br />

Cost at 1 July 786.8 800.8<br />

Addition due to acquisition of subsidiary 2.0 -<br />

Capital increases by cash contribution 15.8 -<br />

Capital decrease by paid back cash contribution (4.5) -<br />

Disposal due to liquidation of companies (4.2) (14.0)<br />

Disposal due to sale of equity interests (0.2) -<br />

Cost at 30 June 795.7 786.8<br />

Write-downs at 1 July (329.5) (322.7)<br />

Write-downs in <strong>2008</strong>/<strong>09</strong> (24.6) (6.8)<br />

Write-downs at 30 June (354.1) (329.5)<br />

Carrying amount at 30 June 441.6 457.3<br />

An overview of the Group structure may be found at the back of the financial statements.<br />

Revenue from equity interests in subsidiaries amounts to net DKK 10.6 million (DKK 22.1 million DKK in<br />

2007/08) and comprises the share of profit from subsidiaries that are not in excess of the combined earnings in<br />

the subsidiary since the acquisition deducted the amortization of the equity interests and receivables<br />

A loss of DKK 18.4 million (2007/08: DKK 14.0 million) related to short-term receivables of subsidiaries is recognised<br />

in the income statement.<br />

<strong>IC</strong> <strong>Companys</strong> – Årsrapport <strong>2008</strong>/<strong>09</strong><br />

82