IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

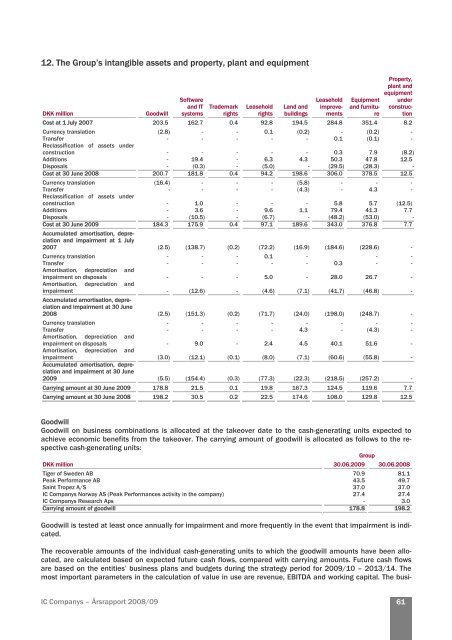

12. The Group’s intangible assets and property, plant and equipment<br />

DKK million Goodwill<br />

Software<br />

and IT<br />

systems<br />

Trademark<br />

rights<br />

Leasehold<br />

rights<br />

Land and<br />

buildings<br />

Leasehold<br />

improvements<br />

Equipment<br />

and furniture<br />

Property,<br />

plant and<br />

equipment<br />

under<br />

construction<br />

Cost at 1 July 2007 203.5 162.7 0.4 92.8 194.5 284.8 351.4 8.2<br />

Currency translation (2.8) - - 0.1 (0.2) - (0.2) -<br />

Transfer<br />

Reclassification of assets under<br />

- - - - - 0.1 (0.1) -<br />

construction<br />

-<br />

-<br />

-<br />

-<br />

-<br />

0.3<br />

7.9 (8.2)<br />

Additions - 19.4 - 6.3 4.3 50.3 47.8 12.5<br />

Disposals - (0.3) - (5.0) - (29.5) (28.3) -<br />

Cost at 30 June <strong>2008</strong> 200.7 181.8 0.4 94.2 198.6 306.0 378.5 12.5<br />

Currency translation (16.4) - - - (5.8) - - -<br />

Transfer<br />

Reclassification of assets under<br />

- - - - (4.3) - 4.3<br />

-<br />

construction<br />

- 1.0 - - - 5.8 5.7 (12.5)<br />

Additions - 3.6 - 9.6 1.1 79.4 41.3 7.7<br />

Disposals - (10.5) - (6.7) - (48.2) (53.0) -<br />

Cost at 30 June 20<strong>09</strong> 184.3 175.9 0.4 97.1 189.6 343.0 376.8 7.7<br />

Accumulated amortisation, depreciation<br />

and impairment at 1 July<br />

2007<br />

(2.5) (138.7) (0.2)<br />

(72.2) (16.9) (184.6)<br />

(228.6)<br />

Currency translation - - - 0.1 - - -<br />

Transfer - - - - - 0.3 - -<br />

Amortisation, depreciation and<br />

impairment on disposals<br />

Amortisation, depreciation and<br />

impairment<br />

Accumulated amortisation, depreciation<br />

and impairment at 30 June<br />

<strong>2008</strong><br />

-<br />

-<br />

-<br />

5.0<br />

- (12.6) - (4.6) (7.1) (41.7) (46.8) -<br />

(2.5) (151.3) (0.2)<br />

-<br />

28.0<br />

(71.7) (24.0) (198.0)<br />

26.7<br />

(248.7)<br />

Currency translation - - - - - - -<br />

-<br />

Transfer - - - - 4.3 - (4.3)<br />

-<br />

Amortisation, depreciation and<br />

impairment on disposals<br />

- 9.0<br />

- 2.4 4.5 40.1 51.6<br />

-<br />

Amortisation, depreciation and<br />

impairment<br />

Accumulated amortisation, depreciation<br />

and impairment at 30 June<br />

(3.0) (12.1) (0.1) (8.0) (7.1) (60.6) (55.8) -<br />

20<strong>09</strong><br />

(5.5) (154.4) (0.3) (77.3) (22.3) (218.5) (257.2) -<br />

Carrying amount at 30 June 20<strong>09</strong> 178.8 21.5 0.1 19.8 167.3 124.5 119.6 7.7<br />

Carrying amount at 30 June <strong>2008</strong> 198.2 30.5 0.2 22.5 174.6 108.0 129.8 12.5<br />

Goodwill<br />

Goodwill on business combinations is allocated at the takeover date to the cash-generating units expected to<br />

achieve economic benefits from the takeover. The carrying amount of goodwill is allocated as follows to the respective<br />

cash-generating units:<br />

Group<br />

DKK million 30.06.20<strong>09</strong> 30.06.<strong>2008</strong><br />

Tiger of Sweden AB 70.9 81.1<br />

Peak Performance AB 43.5 49.7<br />

Saint Tropez A/S 37.0 37.0<br />

<strong>IC</strong> <strong>Companys</strong> Norway AS (Peak Performances activity in the company) 27.4 27.4<br />

<strong>IC</strong> <strong>Companys</strong> Research Aps - 3.0<br />

Carrying amount of goodwill 178.8 198.2<br />

Goodwill is tested at least once annually for impairment and more frequently in the event that impairment is indicated.<br />

The recoverable amounts of the individual cash-generating units to which the goodwill amounts have been allocated,<br />

are calculated based on expected future cash flows, compared with carrying amounts. Future cash flows<br />

are based on the entities’ business plans and budgets during the strategy period for 20<strong>09</strong>/10 – 2013/14. The<br />

most important parameters in the calculation of value in use are revenue, EBITDA and working capital. The busi-<br />

<strong>IC</strong> <strong>Companys</strong> – Årsrapport <strong>2008</strong>/<strong>09</strong><br />

61<br />

-<br />

-<br />

-