IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

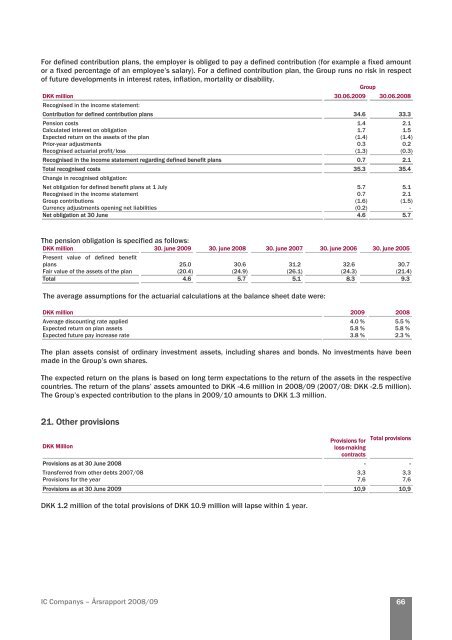

For defined contribution plans, the employer is obliged to pay a defined contribution (for example a fixed amount<br />

or a fixed percentage of an employee’s salary). For a defined contribution plan, the Group runs no risk in respect<br />

of future developments in interest rates, inflation, mortality or disability.<br />

Group<br />

DKK million 30.06.20<strong>09</strong> 30.06.<strong>2008</strong><br />

Recognised in the income statement:<br />

Contribution for defined contribution plans 34.6 33.3<br />

Pension costs 1.4 2.1<br />

Calculated interest on obligation 1.7 1.5<br />

Expected return on the assets of the plan (1.4) (1.4)<br />

Prior-year adjustments 0.3 0.2<br />

Recognised actuarial profit/loss (1.3) (0.3)<br />

Recognised in the income statement regarding defined benefit plans 0.7 2.1<br />

Total recognised costs 35.3 35.4<br />

Change in recognised obligation:<br />

Net obligation for defined benefit plans at 1 July 5.7 5.1<br />

Recognised in the income statement 0.7 2.1<br />

Group contributions (1.6) (1.5)<br />

Currency adjustments opening net liabilities (0.2) -<br />

Net obligation at 30 June 4.6 5.7<br />

The pension obligation is specified as follows:<br />

DKK million 30. june 20<strong>09</strong> 30. june <strong>2008</strong> 30. june 2007 30. june 2006 30. june 2005<br />

Present value of defined benefit<br />

plans 25.0 30.6 31.2 32.6 30.7<br />

Fair value of the assets of the plan (20.4) (24.9) (26.1) (24.3) (21.4)<br />

Total 4.6 5.7 5.1 8.3 9.3<br />

The average assumptions for the actuarial calculations at the balance sheet date were:<br />

DKK million 20<strong>09</strong> <strong>2008</strong><br />

Average discounting rate applied 4.0 % 5.5 %<br />

Expected return on plan assets 5.8 % 5.8 %<br />

Expected future pay increase rate 3.8 % 2.3 %<br />

The plan assets consist of ordinary investment assets, including shares and bonds. No investments have been<br />

made in the Group’s own shares.<br />

The expected return on the plans is based on long term expectations to the return of the assets in the respective<br />

countries. The return of the plans’ assets amounted to DKK -4.6 million in <strong>2008</strong>/<strong>09</strong> (2007/08: DKK -2.5 million).<br />

The Group’s expected contribution to the plans in 20<strong>09</strong>/10 amounts to DKK 1.3 million.<br />

21. Other provisions<br />

DKK Million<br />

Provisions for<br />

loss-making<br />

contracts<br />

Total provisions<br />

Provisions as at 30 June <strong>2008</strong> - -<br />

Transferred from other debts 2007/08 3,3 3,3<br />

Provisions for the year 7,6 7,6<br />

Provisions as at 30 June 20<strong>09</strong> 10,9 10,9<br />

DKK 1.2 million of the total provisions of DKK 10.9 million will lapse within 1 year.<br />

<strong>IC</strong> <strong>Companys</strong> – Årsrapport <strong>2008</strong>/<strong>09</strong><br />

66