IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

time limit in pursuance thereof. Therefore, we have requested the authorities to appoint an advisory committee,<br />

who shall decide how the transfer pricing principles should be eliminated.<br />

In the financial year 2007/08 <strong>IC</strong> <strong>Companys</strong>’ other German sales company has been subject to a tax audit. The<br />

audit of the years under review has generated a tax loss of DKK 55 million. Based on their audit, the German tax<br />

authorities have increased the income for the years under review by 65 million. As in the case above, the argument<br />

is that the transfer pricing principles have not been correctly applied. Equal to the other case, the Danish<br />

authorities have rejected to perform corresponding adjustments. As in the case mentioned above, the case will be<br />

brought before an EC Arbitration Commission and preliminary proceedings are ongoing.<br />

Historically, cases brought before the EC Arbitration Commission are lengthy, and on that background a resolution<br />

is not expected for at least six months for the first case and 2 years for the latter. The tax base of these tax losses<br />

and the possible refund of Danish taxes are not recognised in the balance sheet.<br />

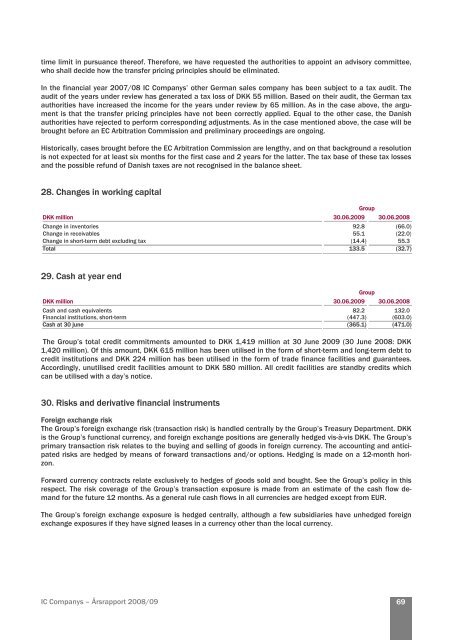

28. Changes in working capital<br />

DKK million 30.06.20<strong>09</strong> 30.06.<strong>2008</strong><br />

Change in inventories 92.8 (66.0)<br />

Change in receivables 55.1 (22.0)<br />

Change in short-term debt excluding tax (14.4) 55.3<br />

Total 133.5 (32.7)<br />

29. Cash at year end<br />

DKK million 30.06.20<strong>09</strong> 30.06.<strong>2008</strong><br />

Cash and cash equivalents 82.2 132.0<br />

Financial institutions, short-term (447.3) (603.0)<br />

Cash at 30 june (365.1) (471.0)<br />

The Group’s total credit commitments amounted to DKK 1,419 million at 30 June 20<strong>09</strong> (30 June <strong>2008</strong>: DKK<br />

1,420 million). Of this amount, DKK 615 million has been utilised in the form of short-term and long-term debt to<br />

credit institutions and DKK 224 million has been utilised in the form of trade finance facilities and guarantees.<br />

Accordingly, unutilised credit facilities amount to DKK 580 million. All credit facilities are standby credits which<br />

can be utilised with a day’s notice.<br />

30. Risks and derivative financial instruments<br />

Foreign exchange risk<br />

The Group’s foreign exchange risk (transaction risk) is handled centrally by the Group’s Treasury Department. DKK<br />

is the Group’s functional currency, and foreign exchange positions are generally hedged vis-à-vis DKK. The Group’s<br />

primary transaction risk relates to the buying and selling of goods in foreign currency. The accounting and anticipated<br />

risks are hedged by means of forward transactions and/or options. Hedging is made on a 12-month horizon.<br />

Forward currency contracts relate exclusively to hedges of goods sold and bought. See the Group’s policy in this<br />

respect. The risk coverage of the Group’s transaction exposure is made from an estimate of the cash flow demand<br />

for the future 12 months. As a general rule cash flows in all currencies are hedged except from EUR.<br />

The Group’s foreign exchange exposure is hedged centrally, although a few subsidiaries have unhedged foreign<br />

exchange exposures if they have signed leases in a currency other than the local currency.<br />

<strong>IC</strong> <strong>Companys</strong> – Årsrapport <strong>2008</strong>/<strong>09</strong><br />

Group<br />

Group<br />

69