IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

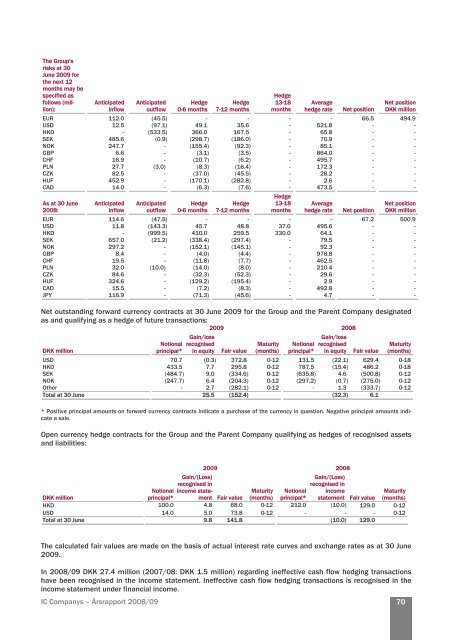

The Group's<br />

risks at 30<br />

June 20<strong>09</strong> for<br />

the next 12<br />

months may be<br />

specified as<br />

follows (million):<br />

Anticipated<br />

inflow<br />

Anticipated<br />

outflow<br />

Hedge<br />

0-6 months<br />

Hedge<br />

7-12 months<br />

Hedge<br />

13-18<br />

months<br />

Average<br />

hedge rate Net position<br />

Net position<br />

DKK million<br />

EUR 112.0 (45.5) - - - - 66.5 494.9<br />

USD 12.5 (97.1) 49.1 35.6 - 521.8 - -<br />

HKD - (533.5) 366.0 167.5 - 65.8 - -<br />

SEK 485.6 (0.9) (298.7) (186.0) - 70.9 - -<br />

NOK 247.7 - (155.4) (92.3) - 85.1 - -<br />

GBP 6.6 - (3.1) (3.5) - 864.0 - -<br />

CHF 16.9 - (10.7) (6.2) - 495.7 - -<br />

PLN 27.7 (3.0) (8.3) (16.4) - 172.3 - -<br />

CZK 82.5 - (37.0) (45.5) - 28.2 - -<br />

HUF 452.9 - (170.1) (282.8) - 2.6 - -<br />

CAD 14.0 - (6.3) (7.6) - 473.5 - -<br />

As at 30 June<br />

<strong>2008</strong>:<br />

Anticipated<br />

inflow<br />

Anticipated<br />

outflow<br />

Hedge<br />

0-6 months<br />

Hedge<br />

7-12 months<br />

Hedge<br />

13-18<br />

months<br />

Average<br />

hedge rate Net position<br />

Net position<br />

DKK million<br />

EUR 114.6 (47.5) - - - - 67.2 500.9<br />

USD 11.8 (143.3) 45.7 48.8 37.0 495.6 -<br />

-<br />

HKD - (999.5) 410.0 259.5 330.0 64.1 -<br />

-<br />

SEK 657.0 (21.2) (338.4) (297.4) - 79.5 - -<br />

NOK 297.2 - (152.1) (145.1) - 92.3 - -<br />

GBP 8.4 - (4.0) (4.4) - 978.8 - -<br />

CHF 19.5 - (11.8) (7.7) - 462.5 - -<br />

PLN 32.0 (10.0) (14.0) (8.0) - 210.4 - -<br />

CZK 84.6 - (32.3) (52.3) - 29.6 - -<br />

HUF 324.6 - (129.2) (195.4) - 2.9 - -<br />

CAD 15.5 - (7.2) (8.3) - 492.8 - -<br />

JPY 116.9 - (71.3) (45.6) - 4.7 - -<br />

Net outstanding forward currency contracts at 30 June 20<strong>09</strong> for the Group and the Parent Company designated<br />

as and qualifying as a hedge of future transactions:<br />

20<strong>09</strong> <strong>2008</strong><br />

DKK million<br />

Notional<br />

principal*<br />

Gain/loss<br />

recognised<br />

in equity Fair value<br />

Maturity<br />

(months)<br />

Notional<br />

principal*<br />

Gain/loss<br />

recognised<br />

in equity Fair value<br />

Maturity<br />

(months)<br />

USD 70.7 (0.3) 372.8 0-12 131.5 (22.1) 629.4 0-18<br />

HKD 433.5 7.7 295.8 0-12 787.5 (15.4) 486.2 0-18<br />

SEK (484.7) 9.0 (334.6) 0-12 (635.8) 4.6 (500.8) 0-12<br />

NOK (247.7) 6.4 (204.3) 0-12 (297.2) (0.7) (275.0) 0-12<br />

Other - 2.7 (282.1) 0-12 - 1.3 (333.7) 0-12<br />

Total at 30 June 25.5 (152.4) (32.3) 6.1<br />

* Positive principal amounts on forward currency contracts indicate a purchase of the currency in question. Negative principal amounts indicate<br />

a sale.<br />

Open currency hedge contracts for the Group and the Parent Company qualifying as hedges of recognised assets<br />

and liabilities:<br />

20<strong>09</strong> <strong>2008</strong><br />

Gain/(Loss)<br />

recognised in<br />

income statement<br />

Fair value<br />

Gain/(Loss)<br />

recognised in<br />

income<br />

statement Fair value<br />

Notional<br />

Maturity Notional<br />

Maturity<br />

DKK million<br />

principal*<br />

(months) principal*<br />

(months)<br />

HKD 100.0 4.8 68.0 0-12 212.0 (10.0) 129.0 0-12<br />

USD 14.0 5.0 73.8 0-12 - - - 0-12<br />

Total at 30 June 9.8 141.8 (10.0) 129.0<br />

The calculated fair values are made on the basis of actual interest rate curves and exchange rates as at 30 June<br />

20<strong>09</strong>.<br />

In <strong>2008</strong>/<strong>09</strong> DKK 27.4 million (2007/08: DKK 1.5 million) regarding ineffective cash flow hedging transactions<br />

have been recognised in the income statement. Ineffective cash flow hedging transactions is recognised in the<br />

income statement under financial income.<br />

<strong>IC</strong> <strong>Companys</strong> – Årsrapport <strong>2008</strong>/<strong>09</strong><br />

70