IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Neither the Group nor the Parent Company has any open currency hedge contracts that do not qualify for hedge<br />

accounting at 30 June 20<strong>09</strong> or at 30 June <strong>2008</strong>.<br />

The recognised positive/negative market values in equity have been treated in accordance with the rules for<br />

hedging of future cash flows and are closed/adjusted during the year after the “hedge accounting principles”.<br />

The net position of the Group calculated after the value at risk method will maximally result in a loss of DKK 1.8<br />

million. The calculation is made by using a 95% confidence interval with a term of 6 months. Value at risk states<br />

the amount that maximally can be lost on a position calculated by using volatilities on the different currencies as<br />

well as correlations between the currencies. The calculation is made by using historical data.<br />

Apart from derivative financial instruments entered into to hedge foreign exchange risks in the balance sheet, no<br />

changes to the fair value of unlisted financial assets and liabilities have been recognised in the income statement.<br />

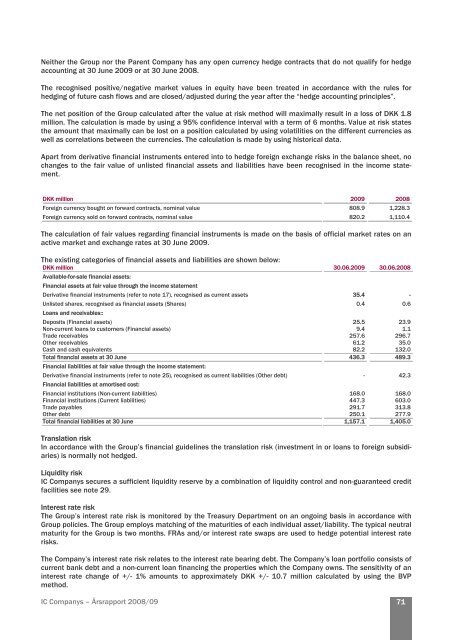

DKK million 20<strong>09</strong> <strong>2008</strong><br />

Foreign currency bought on forward contracts, nominal value 808.9 1,228.3<br />

Foreign currency sold on forward contracts, nominal value 820.2 1,110.4<br />

The calculation of fair values regarding financial instruments is made on the basis of official market rates on an<br />

active market and exchange rates at 30 June 20<strong>09</strong>.<br />

The existing categories of financial assets and liabilities are shown below:<br />

DKK million 30.06.20<strong>09</strong> 30.06.<strong>2008</strong><br />

Available-for-sale financial assets:<br />

Financial assets at fair value through the income statement<br />

Derivative financial instruments (refer to note 17), recognised as current assets 35.4 -<br />

Unlisted shares, recognised as financial assets (Shares) 0.4 0.6<br />

Loans and receivables::<br />

Deposits (Financial assets) 25.5 23.9<br />

Non-current loans to customers (Financial assets) 9.4 1.1<br />

Trade receivables 257.6 296.7<br />

Other receivables 61.2 35.0<br />

Cash and cash equivalents 82.2 132.0<br />

Total financial assets at 30 June 436.3 489.3<br />

Financial liabilities at fair value through the income statement:<br />

Derivative financial instruments (refer to note 25), recognised as current liabilities (Other debt) - 42.3<br />

Financial liabilities at amortised cost:<br />

Financial institutions (Non-current liabilities) 168.0 168.0<br />

Financial institutions (Current liabilities) 447.3 603.0<br />

Trade payables 291.7 313.8<br />

Other debt 250.1 277.9<br />

Total financial liabilities at 30 June 1,157.1 1,405.0<br />

Translation risk<br />

In accordance with the Group’s financial guidelines the translation risk (investment in or loans to foreign subsidiaries)<br />

is normally not hedged.<br />

Liquidity risk<br />

<strong>IC</strong> <strong>Companys</strong> secures a sufficient liquidity reserve by a combination of liquidity control and non-guaranteed credit<br />

facilities see note 29.<br />

Interest rate risk<br />

The Group’s interest rate risk is monitored by the Treasury Department on an ongoing basis in accordance with<br />

Group policies. The Group employs matching of the maturities of each individual asset/liability. The typical neutral<br />

maturity for the Group is two months. FRAs and/or interest rate swaps are used to hedge potential interest rate<br />

risks.<br />

The Company’s interest rate risk relates to the interest rate bearing debt. The Company’s loan portfolio consists of<br />

current bank debt and a non-current loan financing the properties which the Company owns. The sensitivity of an<br />

interest rate change of +/- 1% amounts to approximately DKK +/- 10.7 million calculated by using the BVP<br />

method.<br />

<strong>IC</strong> <strong>Companys</strong> – Årsrapport <strong>2008</strong>/<strong>09</strong><br />

71