IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

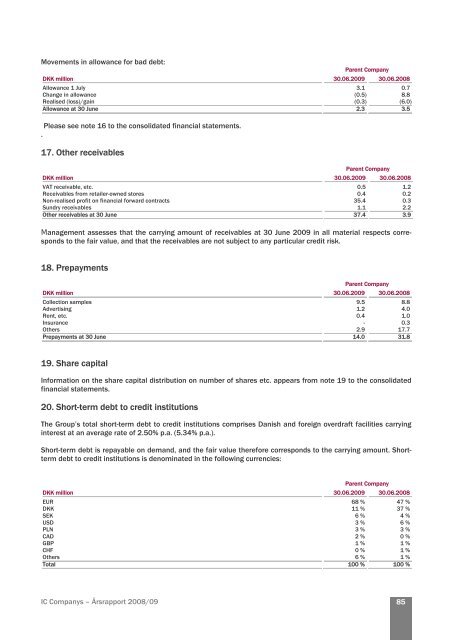

Movements in allowance for bad debt:<br />

Parent Company<br />

DKK million 30.06.20<strong>09</strong> 30.06.<strong>2008</strong><br />

Allowance 1 July 3.1 0.7<br />

Change in allowance (0.5) 8.8<br />

Realised (loss)/gain (0.3) (6.0)<br />

Allowance at 30 June 2.3 3.5<br />

Please see note 16 to the consolidated financial statements.<br />

.<br />

17. Other receivables<br />

Parent Company<br />

DKK million 30.06.20<strong>09</strong> 30.06.<strong>2008</strong><br />

VAT receivable, etc. 0.5 1.2<br />

Receivables from retailer-owned stores 0.4 0.2<br />

Non-realised profit on financial forward contracts 35.4 0.3<br />

Sundry receivables 1.1 2.2<br />

Other receivables at 30 June 37.4 3.9<br />

Management assesses that the carrying amount of receivables at 30 June 20<strong>09</strong> in all material respects corresponds<br />

to the fair value, and that the receivables are not subject to any particular credit risk.<br />

18. Prepayments<br />

Parent Company<br />

DKK million 30.06.20<strong>09</strong> 30.06.<strong>2008</strong><br />

Collection samples 9.5 8.8<br />

Advertising 1.2 4.0<br />

Rent, etc. 0.4 1.0<br />

Insurance - 0.3<br />

Others 2.9 17.7<br />

Prepayments at 30 June 14.0 31.8<br />

19. Share capital<br />

Information on the share capital distribution on number of shares etc. appears from note 19 to the consolidated<br />

financial statements.<br />

20. Short-term debt to credit institutions<br />

The Group’s total short-term debt to credit institutions comprises Danish and foreign overdraft facilities carrying<br />

interest at an average rate of 2.50% p.a. (5.34% p.a.).<br />

Short-term debt is repayable on demand, and the fair value therefore corresponds to the carrying amount. Shortterm<br />

debt to credit institutions is denominated in the following currencies:<br />

Parent Company<br />

DKK million 30.06.20<strong>09</strong> 30.06.<strong>2008</strong><br />

EUR 68 % 47 %<br />

DKK 11 % 37 %<br />

SEK 6 % 4 %<br />

USD 3 % 6 %<br />

PLN 3 % 3 %<br />

CAD 2 % 0 %<br />

GBP 1 % 1 %<br />

CHF 0 % 1 %<br />

Others 6 % 1 %<br />

Total 100 % 100 %<br />

<strong>IC</strong> <strong>Companys</strong> – Årsrapport <strong>2008</strong>/<strong>09</strong><br />

85