IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

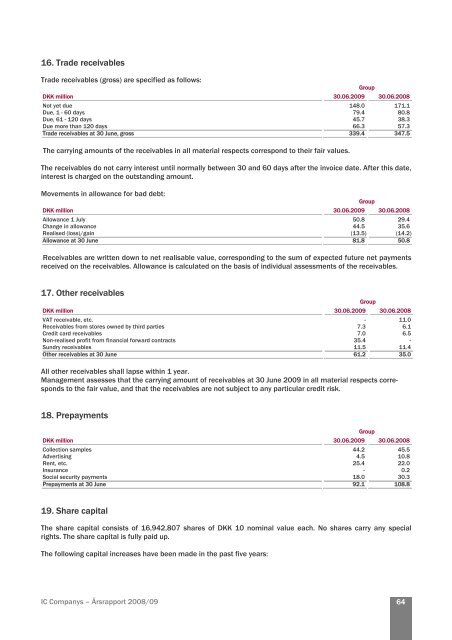

16. Trade receivables<br />

Trade receivables (gross) are specified as follows:<br />

DKK million 30.06.20<strong>09</strong> 30.06.<strong>2008</strong><br />

Not yet due 148.0 171.1<br />

Due, 1 - 60 days 79.4 80.8<br />

Due, 61 - 120 days 45.7 38.3<br />

Due more than 120 days 66.3 57.3<br />

Trade receivables at 30 June, gross 339.4 347.5<br />

The carrying amounts of the receivables in all material respects correspond to their fair values.<br />

The receivables do not carry interest until normally between 30 and 60 days after the invoice date. After this date,<br />

interest is charged on the outstanding amount.<br />

Movements in allowance for bad debt:<br />

DKK million 30.06.20<strong>09</strong> 30.06.<strong>2008</strong><br />

Allowance 1 July 50.8 29.4<br />

Change in allowance 44.5 35.6<br />

Realised (loss)/gain (13.5) (14.2)<br />

Allowance at 30 June 81.8 50.8<br />

Receivables are written down to net realisable value, corresponding to the sum of expected future net payments<br />

received on the receivables. Allowance is calculated on the basis of individual assessments of the receivables.<br />

17. Other receivables<br />

DKK million 30.06.20<strong>09</strong> 30.06.<strong>2008</strong><br />

VAT receivable, etc. - 11.0<br />

Receivables from stores owned by third parties 7.3 6.1<br />

Credit card receivables 7.0 6.5<br />

Non-realised profit from financial forward contracts 35.4 -<br />

Sundry receivables 11.5 11.4<br />

Other receivables at 30 June 61.2 35.0<br />

All other receivables shall lapse within 1 year.<br />

Management assesses that the carrying amount of receivables at 30 June 20<strong>09</strong> in all material respects corresponds<br />

to the fair value, and that the receivables are not subject to any particular credit risk.<br />

18. Prepayments<br />

DKK million 30.06.20<strong>09</strong> 30.06.<strong>2008</strong><br />

Collection samples 44.2 45.5<br />

Advertising 4.5 10.8<br />

Rent, etc. 25.4 22.0<br />

Insurance - 0.2<br />

Social security payments 18.0 30.3<br />

Prepayments at 30 June 92.1 108.8<br />

19. Share capital<br />

The share capital consists of 16,942,807 shares of DKK 10 nominal value each. No shares carry any special<br />

rights. The share capital is fully paid up.<br />

The following capital increases have been made in the past five years:<br />

<strong>IC</strong> <strong>Companys</strong> – Årsrapport <strong>2008</strong>/<strong>09</strong><br />

Group<br />

Group<br />

Group<br />

Group<br />

64