IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Number<br />

Nominal value<br />

(kDKK)<br />

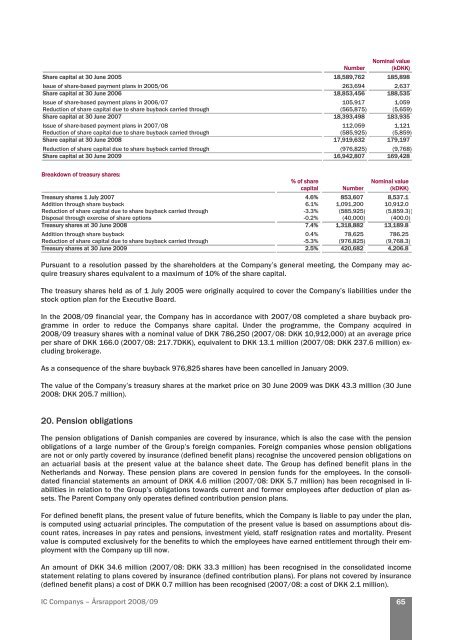

Share capital at 30 June 2005 18,589,762 185,898<br />

Issue of share-based payment plans in 2005/06 263,694 2,637<br />

Share capital at 30 June 2006 18,853,456 188,535<br />

Issue of share-based payment plans in 2006/07 105,917 1,059<br />

Reduction of share capital due to share buyback carried through (565,875) (5,659)<br />

Share capital at 30 June 2007 18,393,498 183,935<br />

Issue of share-based payment plans in 2007/08 112,059 1,121<br />

Reduction of share capital due to share buyback carried through (585,925) (5,859)<br />

Share capital at 30 June <strong>2008</strong> 17,919,632 179,197<br />

Reduction of share capital due to share buyback carried through (976,825) (9,768)<br />

Share capital at 30 June 20<strong>09</strong> 16,942,807 169,428<br />

Breakdown of treasury shares:<br />

% of share<br />

capital Number<br />

Nominal value<br />

(kDKK)<br />

Treasury shares 1 July 2007 4.6% 853,607 8,537.1<br />

Addition through share buyback 6.1% 1,<strong>09</strong>1,200 10,912.0<br />

Reduction of share capital due to share buyback carried through -3.3% (585,925) (5,859.3) )<br />

Disposal through exercise of share options -0.2% (40,000) (400.0)<br />

Treasury shares at 30 June <strong>2008</strong> 7.4% 1,318,882 13,189.8<br />

Addition through share buyback 0.4% 78,625 786.25<br />

Reduction of share capital due to share buyback carried through -5.3% (976,825) (9,768.3)<br />

Treasury shares at 30 June 20<strong>09</strong> 2.5% 420,682 4,206.8<br />

Pursuant to a resolution passed by the shareholders at the Company’s general meeting, the Company may acquire<br />

treasury shares equivalent to a maximum of 10% of the share capital.<br />

The treasury shares held as of 1 July 2005 were originally acquired to cover the Company’s liabilities under the<br />

stock option plan for the Executive Board.<br />

In the <strong>2008</strong>/<strong>09</strong> financial year, the Company has in accordance with 2007/08 completed a share buyback programme<br />

in order to reduce the <strong>Companys</strong> share capital. Under the programme, the Company acquired in<br />

<strong>2008</strong>/<strong>09</strong> treasury shares with a nominal value of DKK 786,250 (2007/08: DKK 10,912,000) at an average price<br />

per share of DKK 166.0 (2007/08: 217.7DKK), equivalent to DKK 13.1 million (2007/08: DKK 237.6 million) excluding<br />

brokerage.<br />

As a consequence of the share buyback 976,825 shares have been cancelled in January 20<strong>09</strong>.<br />

The value of the Company’s treasury shares at the market price on 30 June 20<strong>09</strong> was DKK 43.3 million (30 June<br />

<strong>2008</strong>: DKK 205.7 million).<br />

20. Pension obligations<br />

The pension obligations of Danish companies are covered by insurance, which is also the case with the pension<br />

obligations of a large number of the Group’s foreign companies. Foreign companies whose pension obligations<br />

are not or only partly covered by insurance (defined benefit plans) recognise the uncovered pension obligations on<br />

an actuarial basis at the present value at the balance sheet date. The Group has defined benefit plans in the<br />

Netherlands and Norway. These pension plans are covered in pension funds for the employees. In the consolidated<br />

financial statements an amount of DKK 4.6 million (2007/08: DKK 5.7 million) has been recognised in liabilities<br />

in relation to the Group’s obligations towards current and former employees after deduction of plan assets.<br />

The Parent Company only operates defined contribution pension plans.<br />

For defined benefit plans, the present value of future benefits, which the Company is liable to pay under the plan,<br />

is computed using actuarial principles. The computation of the present value is based on assumptions about discount<br />

rates, increases in pay rates and pensions, investment yield, staff resignation rates and mortality. Present<br />

value is computed exclusively for the benefits to which the employees have earned entitlement through their employment<br />

with the Company up till now.<br />

An amount of DKK 34.6 million (2007/08: DKK 33.3 million) has been recognised in the consolidated income<br />

statement relating to plans covered by insurance (defined contribution plans). For plans not covered by insurance<br />

(defined benefit plans) a cost of DKK 0.7 million has been recognised (2007/08: a cost of DKK 2.1 million).<br />

<strong>IC</strong> <strong>Companys</strong> – Årsrapport <strong>2008</strong>/<strong>09</strong><br />

65