IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

IC Companys â Annual Report 2008/09 0 - IC Companys A/S

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

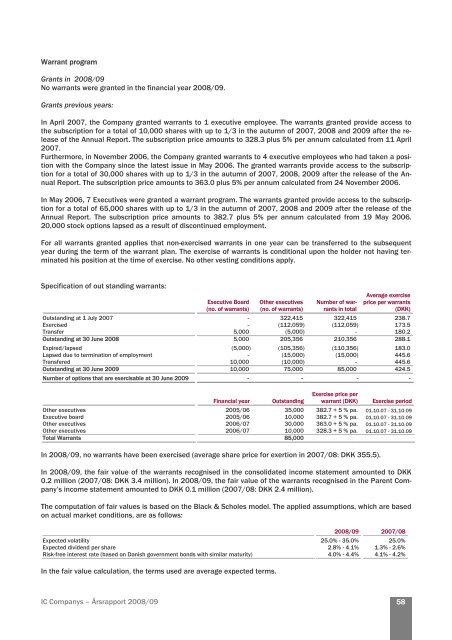

Warrant program<br />

Grants in <strong>2008</strong>/<strong>09</strong><br />

No warrants were granted in the financial year <strong>2008</strong>/<strong>09</strong>.<br />

Grants previous years:<br />

In April 2007, the Company granted warrants to 1 executive employee. The warrants granted provide access to<br />

the subscription for a total of 10,000 shares with up to 1/3 in the autumn of 2007, <strong>2008</strong> and 20<strong>09</strong> after the release<br />

of the <strong>Annual</strong> <strong>Report</strong>. The subscription price amounts to 328.3 plus 5% per annum calculated from 11 April<br />

2007.<br />

Furthermore, in November 2006, the Company granted warrants to 4 executive employees who had taken a position<br />

with the Company since the latest issue in May 2006. The granted warrants provide access to the subscription<br />

for a total of 30,000 shares with up to 1/3 in the autumn of 2007, <strong>2008</strong>, 20<strong>09</strong> after the release of the <strong>Annual</strong><br />

<strong>Report</strong>. The subscription price amounts to 363.0 plus 5% per annum calculated from 24 November 2006.<br />

In May 2006, 7 Executives were granted a warrant program. The warrants granted provide access to the subscription<br />

for a total of 65,000 shares with up to 1/3 in the autumn of 2007, <strong>2008</strong> and 20<strong>09</strong> after the release of the<br />

<strong>Annual</strong> <strong>Report</strong>. The subscription price amounts to 382.7 plus 5% per annum calculated from 19 May 2006.<br />

20,000 stock options lapsed as a result of discontinued employment.<br />

For all warrants granted applies that non-exercised warrants in one year can be transferred to the subsequent<br />

year during the term of the warrant plan. The exercise of warrants is conditional upon the holder not having terminated<br />

his position at the time of exercise. No other vesting conditions apply.<br />

Specification of out standing warrants:<br />

Executive Board<br />

(no. of warrants)<br />

Other executives<br />

(no. of warrants)<br />

Number of warrants<br />

in total<br />

Average exercise<br />

price per warrants<br />

(DKK)<br />

Outstanding at 1 July 2007 - 322,415 322,415 238.7<br />

Exercised - (112,059) (112,059) 173.5<br />

Transfer 5,000 (5,000) - 180.2<br />

Outstanding at 30 June <strong>2008</strong> 5,000 205,356 210,356 288.1<br />

Expired/lapsed (5,000) (105,356) (110,356) 183.0<br />

Lapsed due to termination of employment - (15,000) (15,000) 445.6<br />

Transfered 10,000 (10,000) - 445.6<br />

Outstanding at 30 June 20<strong>09</strong> 10,000 75,000 85,000 424.5<br />

Number of options that are exercisable at 30 June 20<strong>09</strong> - - - -<br />

Financial year Outstanding<br />

Exercise price per<br />

warrant (DKK) Exercise period<br />

Other executives 2005/06 35,000 382.7 + 5 % pa. 01.10.07 - 31.10.<strong>09</strong><br />

Executive board 2005/06 10,000 382.7 + 5 % pa. 01.10.07 - 31.10.<strong>09</strong><br />

Other executives 2006/07 30,000 363.0 + 5 % pa. 01.10.07 - 31.10.<strong>09</strong><br />

Other executives 2006/07 10,000 328.3 + 5 % pa. 01.10.07 - 31.10.<strong>09</strong><br />

Total Warrants 85,000<br />

In <strong>2008</strong>/<strong>09</strong>, no warrants have been exercised (average share price for exertion in 2007/08: DKK 355.5).<br />

In <strong>2008</strong>/<strong>09</strong>, the fair value of the warrants recognised in the consolidated income statement amounted to DKK<br />

0.2 million (2007/08: DKK 3.4 million). In <strong>2008</strong>/<strong>09</strong>, the fair value of the warrants recognised in the Parent Company’s<br />

income statement amounted to DKK 0.1 million (2007/08: DKK 2.4 million).<br />

The computation of fair values is based on the Black & Scholes model. The applied assumptions, which are based<br />

on actual market conditions, are as follows:<br />

<strong>2008</strong>/<strong>09</strong> 2007/08<br />

Expected volatility 25.0% - 35.0% 25.0%<br />

Expected dividend per share 2.8% - 4.1% 1.3% - 2.6%<br />

Risk-free interest rate (based on Danish government bonds with similar maturity) 4.0% - 4.4% 4.1% - 4.2%<br />

In the fair value calculation, the terms used are average expected terms.<br />

<strong>IC</strong> <strong>Companys</strong> – Årsrapport <strong>2008</strong>/<strong>09</strong><br />

58