Français/English - Arab Banking Corporation, ALGERIA

Français/English - Arab Banking Corporation, ALGERIA

Français/English - Arab Banking Corporation, ALGERIA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Risk Management<br />

l Training and awareness-raising: in addition to the awarenessraising<br />

messages dedicated to IT security, ONLINE training,<br />

initiated by the group, was launched in December 2012.<br />

3. Liquidity risk<br />

ABC Algeria, just like the country’s other banks, has been in a<br />

situation of surplus liquidity for many years. The decision of the<br />

monetary authority to increase the minimum capital of banks to<br />

ten billion dinars has accentuated this phenomenon, although<br />

the Bank of Algeria has put in place means to reduce this surplus<br />

liquidity, such as the liquidity reversal and the compensated<br />

deposit facility.<br />

The liquidity risk reflects the Bank’s capacity to satisfy the<br />

withdrawal requests of its customers and to pay its various<br />

obligations to its creditors in the short-term. To check this capacity,<br />

the risk management department is responsible for monitoring the<br />

level of the mandatory reserves held, the regulatory liquidity ratios,<br />

and for establishing stress tests scenarios on a quarterly basis.<br />

These scenarios are then notified to the ad hoc committee. Further,<br />

the Bank has a liquidity management policy which mentions<br />

the regulatory obligations to be respected the management,<br />

monitoring and audit tools. The policy also specifies the terms of<br />

managing a potential liquidity crisis.<br />

CREDIT MANAGEMENT<br />

The main missions of the Credit Department are:<br />

l To Approve / Recommend loans after being assured:<br />

– Of the acceptability of the risk in the return standards<br />

– Of compliance with the credit process such as defined by<br />

the Central Bank and the Group’s policy.<br />

l To have risk management tools and a performing MIS<br />

(Management Information System);<br />

l To carry out the necessary monitoring in terms of continuous<br />

supervision and overseeing of risks, and ensuring, where need<br />

be, that provisions are made;<br />

l To outline guidelines and instructions enabling the bank to<br />

have effective management of risks and returns on loans;<br />

l To organise and monitor the recovery of bad debts in close<br />

collaboration with the Legal Department;<br />

l To ensure the implementation of policies in terms of lending in<br />

accordance with the Central Bank and the Group’s policy;<br />

l To assure strict compliance with the lending procedures and<br />

policies.<br />

l Approval of loans in accordance with the limits authorised<br />

and powers delegated, monitoring of loans, annual revisions,<br />

classification and levels of provisions, etc.<br />

l To assure credit training.<br />

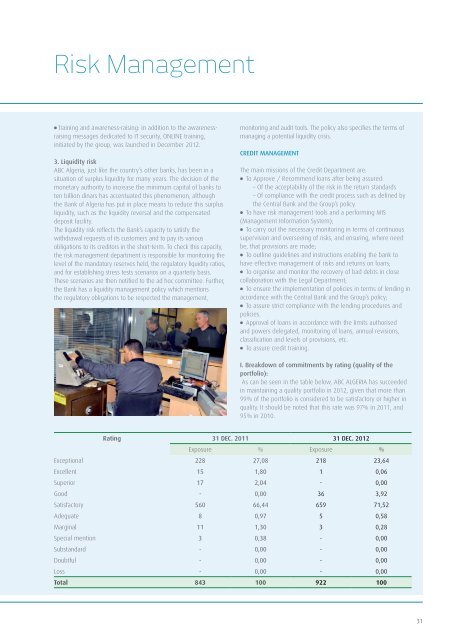

I. Breakdown of commitments by rating (quality of the<br />

portfolio):<br />

As can be seen in the table below, ABC <strong>ALGERIA</strong> has succeeded<br />

in maintaining a quality portfolio in 2012, given that more than<br />

99% of the portfolio is considered to be satisfactory or higher in<br />

quality. It should be noted that this rate was 97% in 2011, and<br />

95% in 2010.<br />

Rating 31 DEC. 2011 31 DEC. 2012<br />

Exposure % Exposure %<br />

Exceptional 228 27,08 218 23,64<br />

Excellent 15 1,80 1 0,06<br />

Superior 17 2,04 - 0,00<br />

Good - 0,00 36 3,92<br />

Satisfactory 560 66,44 659 71,52<br />

Adequate 8 0,97 5 0,58<br />

Marginal 11 1,30 3 0,28<br />

Special mention 3 0,38 - 0,00<br />

Substandard - 0,00 - 0,00<br />

Doubtful - 0,00 - 0,00<br />

Loss - 0,00 - 0,00<br />

Total 843 100 922 100<br />

31