Français/English - Arab Banking Corporation, ALGERIA

Français/English - Arab Banking Corporation, ALGERIA

Français/English - Arab Banking Corporation, ALGERIA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statements 2012<br />

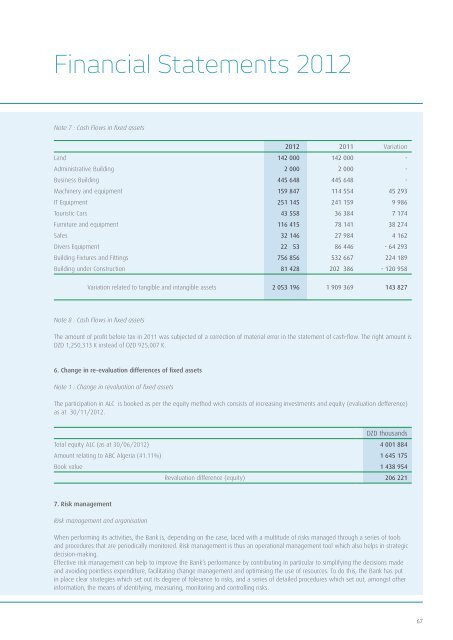

Note 7 : Cash Flows in fixed assets<br />

2012 2011 Variation<br />

Land 142 000 142 000 -<br />

Administrative Building 2 000 2 000 -<br />

Business Building 445 648 445 648 -<br />

Machinery and equipment 159 847 114 554 45 293<br />

IT Equipment 251 145 241 159 9 986<br />

Touristic Cars 43 558 36 384 7 174<br />

Furniture and equipment 116 415 78 141 38 274<br />

Safes 32 146 27 984 4 162<br />

Divers Equipment 22 53 86 446 - 64 293<br />

Building Fixtures and Fittings 756 856 532 667 224 189<br />

Building under Construction 81 428 202 386 - 120 958<br />

Variation related to tangible and intangible assets 2 053 196 1 909 369 143 827<br />

Note 8 : Cash Flows in fixed assets<br />

The amount of profit before tax in 2011 was subjected of a correction of material error in the statement of cash-flow. The right amount is<br />

DZD 1,250,313 K instead of DZD 925,007 K.<br />

6. Change in re-evaluation differences of fixed assets<br />

Note 1 : Change in revaluation of fixed assets<br />

The participation in ALC is booked as per the equity method wich consists of increasing investments and equity (evaluation defference)<br />

as at 30/11/2012.<br />

DZD thousands<br />

Total equity ALC (as at 30/06/2012) 4 001 884<br />

Amount relating to ABC Algeria (41.11%) 1 645 175<br />

Book value 1 438 954<br />

Revaluation difference (equity) 206 221<br />

7. Risk management<br />

Risk management and organisation<br />

When performing its activities, the Bank is, depending on the case, faced with a multitude of risks managed through a series of tools<br />

and procedures that are periodically monitored. Risk management is thus an operational management tool which also helps in strategic<br />

decision-making.<br />

Effective risk management can help to improve the Bank’s performance by contributing in particular to simplifying the decisions made<br />

and avoiding pointless expenditure, facilitating change management and optimising the use of resources. To do this, the Bank has put<br />

in place clear strategies which set out its degree of tolerance to risks, and a series of detailed procedures which set out, amongst other<br />

information, the means of identifying, measuring, monitoring and controlling risks.<br />

67