Français/English - Arab Banking Corporation, ALGERIA

Français/English - Arab Banking Corporation, ALGERIA

Français/English - Arab Banking Corporation, ALGERIA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statements 2012<br />

APPENDIX NO. 5 - APPENDICES TO THE FINANCIAL STATEMENTS<br />

1. Accounting Methods and Rules<br />

The accounts are held and the financial statements of ABC Algeria<br />

are drawn up in accordance with the standards set forth by the<br />

law 07-11 relating to the Financial Accounting System and the<br />

texts taken for its application.<br />

It is also governed by the specific sectoral standards particularly<br />

the Bank of Algeria regulation 09-04 relating to bank accounting<br />

and accounting rules applicable to banks and financial institutions,<br />

the Bank of Algeria regulation 09-05 relating to the drawing up<br />

and publication of the financial statements of banks and financial<br />

institutions, the Bank of Algeria regulation 09-08 relating to the<br />

rules of evaluating and accounting financial instruments by the<br />

banks and financial institutions and the Bank of Algeria regulation<br />

94-18 on the accounting of transactions in foreign currencies.<br />

The transactions are accounted in accordance with the principle<br />

of separating financial years: the interest and related commission<br />

are recorded in the profit and loss account pro rata temporis; the<br />

other commission as well as other revenue are recorded at the<br />

time of their collection or payment.<br />

The financing commitments are registered off-balance sheet as<br />

they are entered into and are transferred to the balance sheet as<br />

the funds are released for the nominal value.<br />

The study and management commission is taken into account in<br />

its entirety in the result at the end of the first release of funds.<br />

Income from pre-discounted loans is taken into account, on<br />

the agreed maturity date, in a debt account attached to an<br />

adjustment account and are added to the bottom line prorata<br />

temporis on each accounting statement.<br />

Income from post-discounted loans is taken into account in the<br />

bottom line as accrued. Interest related to loans categorized as<br />

short-term debts, within the meaning of the order of the Bank<br />

of Algeria 74-94 as amended and completed, is added to the<br />

bottom line as accrued. However, the interest accrued or due and<br />

not yet collected related to loans and debts categorized as high<br />

risk debts (category 3) or compromised debts (category 4) within<br />

the meaning of the Bank of Algeria order 74-94 are recorded<br />

under assets in the item «reserved premiums».<br />

This interest is taken into account on the bottom line when<br />

actually collected.<br />

The bank’s assets are evaluated at the historic cost apart from<br />

debts to customers which are evaluated in accordance with the<br />

aforementioned regulation 09-08. Allowances for categorized<br />

debts are calculated in accordance with the order 74-94 on the<br />

setting down of prudential management rules for banks and<br />

financial institutions.<br />

Fixed assets are evaluated, on the date they become part of<br />

assets, at the purchase price equal to the purchase price plus fees<br />

and incidentals required for rendering the asset ready for use.<br />

Depreciation of fixed assets is done through amortisation.<br />

Transactions in foreign currencies are recorded in the accounts<br />

using the evaluation rules and methods defined by the regulation<br />

94-18 on the accounting of transactions in foreign currencies.<br />

These transactions are recorded in different accounts opened in<br />

each of the currencies used.<br />

The account balances are converted into dinars, on the date of<br />

each account statement, on the basis of the average bid/offer<br />

rate of the Bank of Algeria for each currency.<br />

The «foreign exchange positions» and «foreign exchange position<br />

counter-value» accounts are opened in each of the currencies<br />

for the recording of currency/dinar transactions. The difference<br />

resulting from the foreign exchange position and foreign<br />

exchange position counter-value balances is reported in the profit<br />

and loss account.<br />

2. Information of the balance sheet<br />

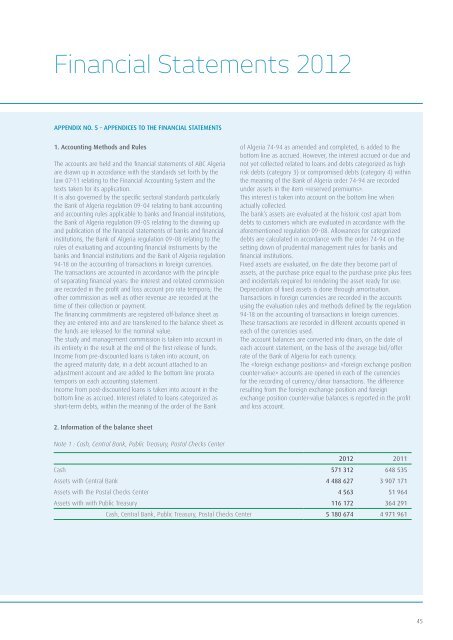

Note 1 : Cash, Central Bank, Public Treasury, Postal Checks Center<br />

2012 2011<br />

Cash 571 312 648 535<br />

Assets with Central Bank 4 488 627 3 907 171<br />

Assets with the Postal Checks Center 4 563 51 964<br />

Assets with with Public Treasury 116 172 364 291<br />

Cash, Central Bank, Public Treasury, Postal Checks Center 5 180 674 4 971 961<br />

45