NHS pay review body: twenty-sixth report 2012 - Official Documents

NHS pay review body: twenty-sixth report 2012 - Official Documents

NHS pay review body: twenty-sixth report 2012 - Official Documents

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

28<br />

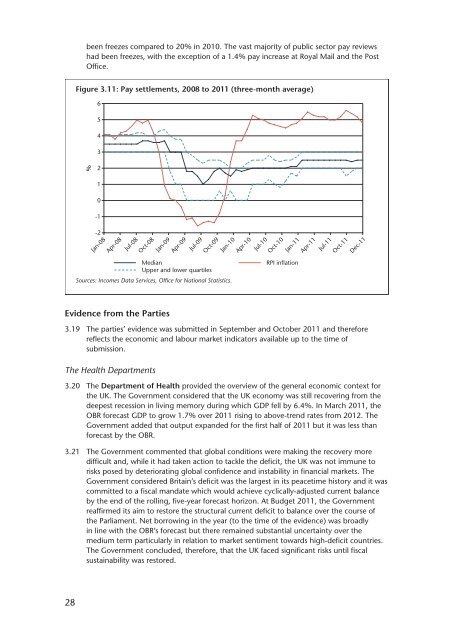

been freezes compared to 20% in 2010. The vast majority of public sector <strong>pay</strong> <strong>review</strong>s<br />

had been freezes, with the exception of a 1.4% <strong>pay</strong> increase at Royal Mail and the Post<br />

Office.<br />

Figure 3.11: Pay settlements, 2008 to 2011 (three-month average)<br />

%<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

Jan-08<br />

Apr-08<br />

Jul-08<br />

Oct-08<br />

Jan-09<br />

Apr-09<br />

Jul-09<br />

Oct-09<br />

Jan-10<br />

Sources: Incomes Data Services, Office for National Statistics.<br />

Evidence from the Parties<br />

Apr-10<br />

Jul-10<br />

Oct-10<br />

Jan-11<br />

Median RPI inflation<br />

Upper and lower quartiles<br />

3.19 The parties’ evidence was submitted in September and October 2011 and therefore<br />

reflects the economic and labour market indicators available up to the time of<br />

submission.<br />

The Health Departments<br />

3.20 The Department of Health provided the overview of the general economic context for<br />

the UK. The Government considered that the UK economy was still recovering from the<br />

deepest recession in living memory during which GDP fell by 6.4%. In March 2011, the<br />

OBR forecast GDP to grow 1.7% over 2011 rising to above-trend rates from <strong>2012</strong>. The<br />

Government added that output expanded for the first half of 2011 but it was less than<br />

forecast by the OBR.<br />

3.21 The Government commented that global conditions were making the recovery more<br />

difficult and, while it had taken action to tackle the deficit, the UK was not immune to<br />

risks posed by deteriorating global confidence and instability in financial markets. The<br />

Government considered Britain’s deficit was the largest in its peacetime history and it was<br />

committed to a fiscal mandate which would achieve cyclically-adjusted current balance<br />

by the end of the rolling, five-year forecast horizon. At Budget 2011, the Government<br />

reaffirmed its aim to restore the structural current deficit to balance over the course of<br />

the Parliament. Net borrowing in the year (to the time of the evidence) was broadly<br />

in line with the OBR’s forecast but there remained substantial uncertainty over the<br />

medium term particularly in relation to market sentiment towards high-deficit countries.<br />

The Government concluded, therefore, that the UK faced significant risks until fiscal<br />

sustainability was restored.<br />

Apr-11<br />

Jul-11<br />

Oct-11<br />

Dec-11