Coming to Terms with Reality. Evaluation of the Belgian Debt Relief ...

Coming to Terms with Reality. Evaluation of the Belgian Debt Relief ...

Coming to Terms with Reality. Evaluation of the Belgian Debt Relief ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

| 176 |<br />

Annexes<br />

Non-Paris Club bilateral credi<strong>to</strong>rs (China, Kuwait, Saudi Arabia) were expected <strong>to</strong> provide a<br />

treatment comparable <strong>to</strong> that <strong>of</strong> <strong>the</strong> Paris Club, <strong>with</strong> <strong>the</strong>ir contribution under <strong>the</strong> enhanced<br />

HIPC Initiative amounting <strong>to</strong> 13.2 million US$ in NPV terms. Kuwait accepted <strong>to</strong> contribute<br />

<strong>to</strong> <strong>the</strong> debt reduction at Completion Point. In 2001 China provided partial debt reduction on<br />

‘standard terms’ and Saudi Arabia accepted a plan for payment <strong>of</strong> arrears in 2000.<br />

Commercial credi<strong>to</strong>rs were also expected <strong>to</strong> provide a treatment comparable <strong>to</strong> that <strong>of</strong> <strong>the</strong><br />

Paris Club. In May 2001, <strong>the</strong> government proposed <strong>to</strong> <strong>the</strong> London Club <strong>to</strong> buy back its<br />

commercial debt (which s<strong>to</strong>od at 810 million US$ on December 31 2000), under <strong>the</strong><br />

International Development Association rules. After lengthy negotiations, an agreement was<br />

reached in May 2002 for <strong>the</strong> country <strong>to</strong> buy back its commercial debt at 14.5% <strong>of</strong> face<br />

value, <strong>with</strong> all <strong>the</strong> interest arrears being cancelled. The operation, costing a <strong>to</strong>tal <strong>of</strong> 44<br />

million US$, <strong>to</strong>ok place in August 2003 <strong>with</strong> contributions from France, Norway and <strong>the</strong><br />

World Bank which coordinated <strong>the</strong> operation. Cameroon contributed some <strong>of</strong> its own<br />

resources and 54 out <strong>of</strong> 76 banks involved agreed on <strong>the</strong> transaction. Participating<br />

commercial credi<strong>to</strong>rs <strong>the</strong>reby delivered <strong>the</strong>ir share <strong>of</strong> HIPC assistance. Five nonparticipating<br />

credi<strong>to</strong>rs, however, put pressure on Cameroon <strong>to</strong> settle claims by resorting <strong>to</strong><br />

litigation in courts or under arbitrage. The <strong>to</strong>tal amount <strong>of</strong> claims entered was 340 million<br />

US$. (The value <strong>of</strong> <strong>the</strong> original claims was 53 million US$.) Two credi<strong>to</strong>rs obtained a - for<br />

<strong>the</strong>m - favourable judgment granting <strong>the</strong>m <strong>the</strong>ir claims for a <strong>to</strong>tal amount <strong>of</strong> 51 million<br />

US$ (IDA and IMF, September 2007, table 16).<br />

The Completion Point triggers set out in <strong>the</strong> Decision Point document included: (i) <strong>the</strong><br />

preparation <strong>of</strong> a full PRSP and satisfac<strong>to</strong>ry implementation for at least one year; (ii) <strong>the</strong><br />

maintenance <strong>of</strong> a stable macroeconomic environment; (iii) <strong>the</strong> satisfac<strong>to</strong>ry use <strong>of</strong> <strong>the</strong><br />

budgetary savings from <strong>the</strong> interim debt service relief; (iv) <strong>the</strong> conclusion and satisfac<strong>to</strong>ry<br />

implementation <strong>of</strong> structural reforms supported by a PRGF loan (2000-2003) and <strong>the</strong> third<br />

Structural Adjustment Credit (SACIII); (v) <strong>the</strong> satisfac<strong>to</strong>ry implementation <strong>of</strong> governance<br />

and anticorruption measures, including in <strong>the</strong> areas <strong>of</strong> judicial and procurement reforms,<br />

budget execution, and <strong>the</strong> creation <strong>of</strong> regula<strong>to</strong>ry agencies; and (vi) <strong>the</strong> satisfac<strong>to</strong>ry<br />

implementation <strong>of</strong> key social reforms, including <strong>the</strong> fight against HIV/AIDS.<br />

The Completion Point for Cameroon was initially set for May 2003. But in <strong>the</strong> meanwhile<br />

problems arose <strong>with</strong> <strong>the</strong> execution <strong>of</strong> <strong>the</strong> program under <strong>the</strong> PRGF (2000-2003). Moreover<br />

<strong>the</strong>re were slippages in <strong>the</strong> area <strong>of</strong> public finance, especially in 2004, including a<br />

considerable decline in non-oil revenues and a rise in certain expenditures, accompanied by<br />

an increase in <strong>the</strong> State’s arrears due <strong>to</strong> domestic public institutions and private suppliers.<br />

3.3 The Completion Point<br />

Macroeconomic policy implementation improved substantially in 2005, as evidenced by<br />

performance under <strong>the</strong> IMF Staff-Moni<strong>to</strong>red Program (SMP) during <strong>the</strong> first half <strong>of</strong> 2005<br />

and <strong>the</strong> start <strong>of</strong> a new PRGF-supported program during <strong>the</strong> second half <strong>of</strong> 2005. Efforts<br />

made in 2005 <strong>to</strong> correct fiscal slippages contributed <strong>to</strong> res<strong>to</strong>ring <strong>the</strong> conditions for<br />

<strong>Coming</strong> <strong>to</strong> <strong>Terms</strong> <strong>with</strong> <strong>Reality</strong><br />

macroeconomic stability and streng<strong>the</strong>ning <strong>the</strong> foundations for sustained growth and<br />

poverty reduction. As a consequence, <strong>the</strong> IMF and IDA recognized that <strong>the</strong> Completion<br />

Point was reached in April 2006, three years later than originally planned.<br />

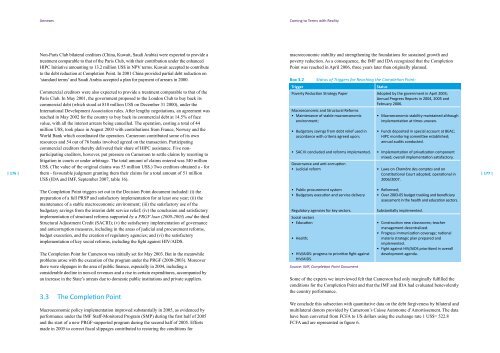

Box 3.2 Status <strong>of</strong> Triggers for Reaching <strong>the</strong> Completion Point:<br />

Trigger Status<br />

Poverty Reduction Strategy Paper<br />

Macroeconomic and Structural Reforms<br />

Adopted by <strong>the</strong> government in April 2003;<br />

Annual Progress Reports in 2004, 2005 and<br />

February 2006.<br />

• Maintenance <strong>of</strong> stable macroeconomic • Macroeconomic stability maintained although<br />

environment;<br />

implementation at times uneven.<br />

• Budgetary savings from debt relief used in<br />

accordance <strong>with</strong> criteria agreed upon;<br />

• SAC III concluded and reforms implemented.<br />

Governance and anti-corruption<br />

• Judicial reform<br />

• Public procurement system<br />

• Budgetary execution and service delivery<br />

Regula<strong>to</strong>ry agencies for key sec<strong>to</strong>rs.<br />

Social sec<strong>to</strong>rs<br />

• Education<br />

• Health;<br />

• HIV/AIDS: progress <strong>to</strong> prioritize fight against<br />

HIV/AIDS.<br />

Source: IMF, Completion Point Document<br />

• Funds deposited in special account at BEAC;<br />

HIPC moni<strong>to</strong>ring committee established;<br />

annual audits conducted.<br />

• Implementation <strong>of</strong> privatization component<br />

mixed; overall implementation satisfac<strong>to</strong>ry.<br />

• Laws on Chambre des comptes and on<br />

Constitutional Court adopted; operational in<br />

2006/2007.<br />

• Reformed;<br />

• Over 2003-05 budget tracking and beneficiary<br />

assessment in <strong>the</strong> health and education sec<strong>to</strong>rs.<br />

Substantially implemented.<br />

• Construction new classrooms; teacher<br />

management decentralized.<br />

• Progress immunization coverage; national<br />

malaria strategic plan prepared and<br />

implemented.<br />

• Fight against HIV/AIDS prioritized in overall<br />

development agenda.<br />

Some <strong>of</strong> <strong>the</strong> experts we interviewed felt that Cameroon had only marginally fulfilled <strong>the</strong><br />

conditions for <strong>the</strong> Completion Point and that <strong>the</strong> IMF and IDA had evaluated benevolently<br />

<strong>the</strong> country performance.<br />

We conclude this subsection <strong>with</strong> quantitative data on <strong>the</strong> debt forgiveness by bilateral and<br />

multilateral donors provided by Cameroon’s Caisse Au<strong>to</strong>nome d’Amortissement. The data<br />

have been converted from FCFA <strong>to</strong> US dollars using <strong>the</strong> exchange rate 1 US$= 522.8<br />

FCFA and are represented in figure 6.<br />

| 177 |