Annual Report 2010 - SBM Offshore

Annual Report 2010 - SBM Offshore

Annual Report 2010 - SBM Offshore

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Review / Financial Statements <strong>2010</strong><br />

The following important financial covenants have been<br />

agreed with the respective lenders (unless stated otherwise,<br />

these relate to both <strong>SBM</strong> <strong>Offshore</strong> N.V. and <strong>SBM</strong><br />

Holding Inc. S.A. consolidated financial statements),<br />

after adjustment of EBITDA and net debt for certain<br />

items and proposed dividend, as defined in the relevant<br />

financing facilities. For the new Revolving Credit Facility<br />

concluded in <strong>2010</strong>, covenants and definitions (at <strong>SBM</strong><br />

<strong>Offshore</strong> level) vary from those of the old facility, which<br />

however still apply to existing Project Finance Facilities,<br />

and are therefore still reported.<br />

• Consolidated tangible net worth to Consolidated<br />

total tangible assets (Solvency) of minimum 25% of<br />

<strong>SBM</strong> <strong>Offshore</strong> N.V. The actual solvency at year-end<br />

<strong>2010</strong> is 41.9%<br />

• Minimum tangible net worth of <strong>SBM</strong> Holding Inc.<br />

S.A. of US$ 490 million. Actual tangible net worth<br />

is US$ 1,894 million (2009: US$ 1,566 million).<br />

Minimum tangible net worth of <strong>SBM</strong> <strong>Offshore</strong> N.V.<br />

of US$ 570 million. Actual tangible net worth is US$<br />

2,005 million (2009: US$ 1,631 million);<br />

• Leverage (net debt : EBITDA ratio) of maximum 3.75<br />

: 1 at year-end. Actual leverage is 2.54 (2009: 2.43)<br />

and 2.49 (2009: 2.39) for <strong>SBM</strong> Holding Inc. S.A.<br />

and <strong>SBM</strong> <strong>Offshore</strong> N.V. respectively; for the new<br />

Revolving Credit Facility, with Adjusted EBITDA definition,<br />

the actual leverage at year-end <strong>2010</strong> is 2.30;<br />

In June <strong>2010</strong>, the Company completed the refinancing<br />

and expansion of its revolving credit facility of US$ 500<br />

million to a new US$ 750 million facility.<br />

The RCF facility has been arranged to help finance the<br />

Company’s temporary cash requirements related to<br />

the supply of turnkey projects or the assets under construction<br />

where project finance is not planned or not<br />

yet put in place.<br />

• Interest cover ratio (EBITDA : net interest expense)<br />

of minimum 5.0 : 1; Actual interest cover ratio is 11.1<br />

(2009: 12.2) and 8.2 (2009: 10.2) for <strong>SBM</strong> Holding<br />

Inc. S.A. and <strong>SBM</strong> <strong>Offshore</strong> N.V. respectively. For<br />

the new Revolving Credit Facility, with an Adjusted<br />

EBITDA definition, the actual interest cover ratio is<br />

9.0;<br />

• Consolidated Adjusted EBITDA of <strong>SBM</strong> Holding Inc.<br />

S.A. must be > 75% of the Consolidated Adjusted<br />

EBITDA of the Company. At year end <strong>2010</strong> the<br />

actual percentage is 102%.<br />

The Company has no ‘off-balance sheet’ financing<br />

through special purpose entities. All long-term debt<br />

is included in the Consolidated statement of financial<br />

postion.<br />

No carrying amounts of long term debt were in default<br />

at the balance sheet date nor at any time during the<br />

year. During the year <strong>2010</strong> and 2009 there were no<br />

breaches of the loan arrangement terms and hence no<br />

default needed to be remedied, or the terms of the loan<br />

arrangement renegotiated, before the financial statements<br />

were authorised for issue.<br />

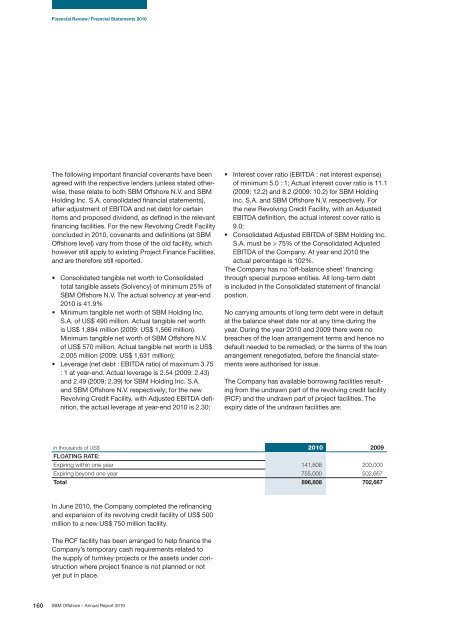

The Company has available borrowing facilities resulting<br />

from the undrawn part of the revolving credit facility<br />

(RCF) and the undrawn part of project facilities. The<br />

expiry date of the undrawn facilities are:<br />

in thousands of US$<br />

FLOATING RATE:<br />

<strong>2010</strong> 2009<br />

Expiring within one year 141,808 200,000<br />

Expiring beyond one year 755,000 502,667<br />

Total 896,808 702,667<br />

160 <strong>SBM</strong> <strong>Offshore</strong> – <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>