Australia Post Annual Report 2008–09

Australia Post Annual Report 2008–09

Australia Post Annual Report 2008–09

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to and forming part of the Financial <strong>Report</strong> for the year ended 30 June 2009<br />

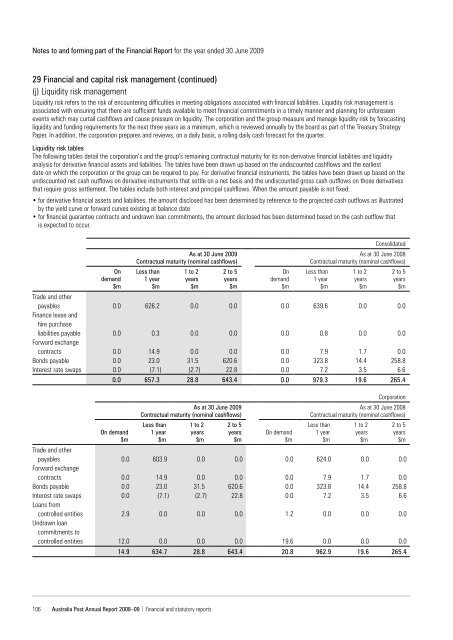

29 Financial and capital risk management (continued)<br />

(j) Liquidity risk management<br />

Liquidity risk refers to the risk of encountering difficulties in meeting obligations associated with financial liabilities. Liquidity risk management is<br />

associated with ensuring that there are sufficient funds available to meet financial commitments in a timely manner and planning for unforeseen<br />

events which may curtail cashflows and cause pressure on liquidity. The corporation and the group measure and manage liquidity risk by forecasting<br />

liquidity and funding requirements for the next three years as a minimum, which is reviewed annually by the board as part of the Treasury Strategy<br />

Paper. In addition, the corporation prepares and reviews, on a daily basis, a rolling daily cash forecast for the quarter.<br />

Liquidity risk tables<br />

The following tables detail the corporation’s and the group’s remaining contractual maturity for its non-derivative financial liabilities and liquidity<br />

analysis for derivative financial assets and liabilities. The tables have been drawn up based on the undiscounted cashflows and the earliest<br />

date on which the corporation or the group can be required to pay. For derivative financial instruments, the tables have been drawn up based on the<br />

undiscounted net cash outflows on derivative instruments that settle on a net basis and the undiscounted gross cash outflows on those derivatives<br />

that require gross settlement. The tables include both interest and principal cashflows. When the amount payable is not fixed:<br />

• for derivative financial assets and liabilities, the amount disclosed has been determined by reference to the projected cash outflows as illustrated<br />

by the yield curve or forward curves existing at balance date<br />

• for financial guarantee contracts and undrawn loan commitments, the amount disclosed has been determined based on the cash outflow that<br />

is expected to occur.<br />

Trade and other<br />

payables<br />

Finance lease and<br />

hire purchase<br />

liabilities payable<br />

Forward exchange<br />

contracts<br />

Bonds payable<br />

Interest rate swaps<br />

Trade and other<br />

payables<br />

Forward exchange<br />

contracts<br />

Bonds payable<br />

Interest rate swaps<br />

Loans from<br />

controlled entities<br />

Undrawn loan<br />

commitments to<br />

controlled entities<br />

106<br />

On<br />

demand<br />

$m<br />

0.0<br />

0.0<br />

0.0<br />

0.0<br />

0.0<br />

As at 30 June 2009<br />

Contractual maturity (nominal cashflows)<br />

Less than<br />

1 year<br />

$m<br />

626.2<br />

1 to 2<br />

years<br />

$m<br />

<strong>Australia</strong> <strong>Post</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008–09</strong> | Financial and statutory reports<br />

0.3<br />

14.9<br />

23.0<br />

(7.1)<br />

0.0<br />

0.0<br />

0.0<br />

31.5<br />

(2.7)<br />

2 to 5<br />

years<br />

$m<br />

0.0<br />

0.0<br />

0.0<br />

620.6<br />

22.8<br />

On<br />

demand<br />

$m<br />

0.0<br />

0.0<br />

0.0<br />

0.0<br />

0.0<br />

Consolidated<br />

As at 30 June 2008<br />

Contractual maturity (nominal cashflows)<br />

Less than<br />

1 year<br />

$m<br />

639.6<br />

0.8<br />

7.9<br />

323.8<br />

7.2<br />

1 to 2<br />

years<br />

$m<br />

0.0<br />

0.0<br />

1.7<br />

14.4<br />

3.5<br />

2 to 5<br />

years<br />

$m<br />

0.0<br />

0.0<br />

0.0<br />

258.8<br />

6.6<br />

0.0 657.3 28.8 643.4 0.0 979.3 19.6 265.4<br />

On demand<br />

$m<br />

0.0<br />

0.0<br />

0.0<br />

0.0<br />

2.9<br />

12.0<br />

As at 30 June 2009<br />

Contractual maturity (nominal cashflows)<br />

Less than<br />

1 year<br />

$m<br />

603.9<br />

14.9<br />

23.0<br />

(7.1)<br />

0.0<br />

0.0<br />

1 to 2<br />

years<br />

$m<br />

0.0<br />

0.0<br />

31.5<br />

(2.7)<br />

0.0<br />

0.0<br />

2 to 5<br />

years<br />

$m<br />

0.0<br />

0.0<br />

620.6<br />

22.8<br />

0.0<br />

0.0<br />

On demand<br />

$m<br />

0.0<br />

0.0<br />

0.0<br />

0.0<br />

1.2<br />

19.6<br />

Corporation<br />

As at 30 June 2008<br />

Contractual maturity (nominal cashflows)<br />

Less than<br />

1 year<br />

$m<br />

624.0<br />

7.9<br />

323.8<br />

7.2<br />

0.0<br />

0.0<br />

1 to 2<br />

years<br />

$m<br />

0.0<br />

1.7<br />

14.4<br />

3.5<br />

0.0<br />

0.0<br />

2 to 5<br />

years<br />

$m<br />

0.0<br />

0.0<br />

258.8<br />

6.6<br />

14.9 634.7 28.8 643.4 20.8 962.9 19.6 265.4<br />

0.0<br />

0.0